Trends in Secondary Market:

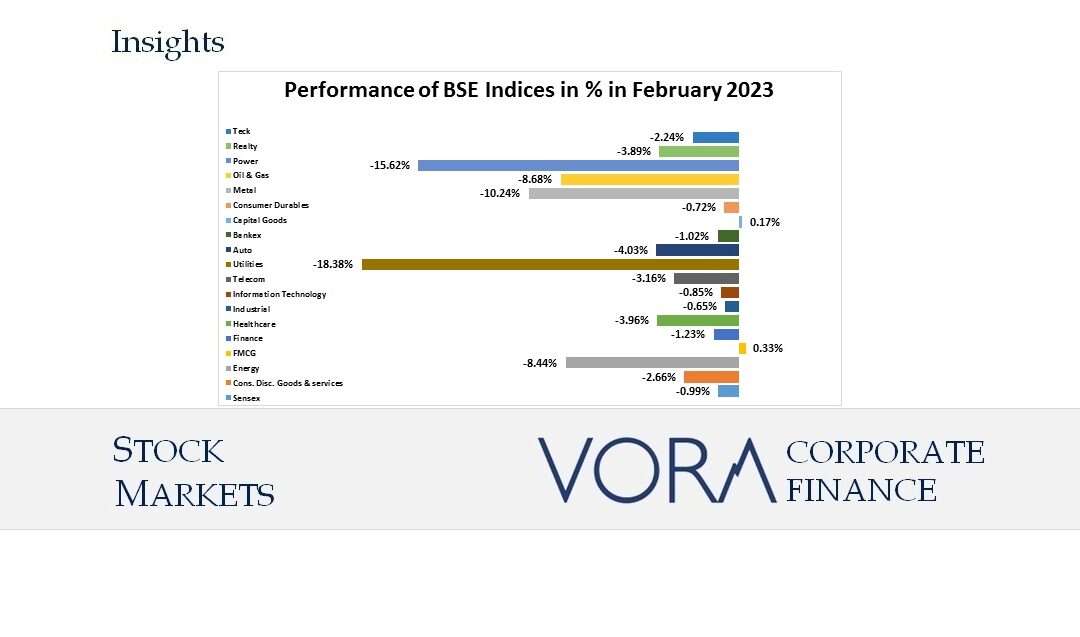

- The momentum in equity markets continued to fall during February 2023, with Nifty and Sensex falling by respectively 17,303.95 and 58,962.12 mark. During February 2023, Nifty and Sensex fell by -2.03 per cent and -0.99 per cent respectively over previous month.

- While the FPIs sold about $3.54 billion of equities on a net basis in January 2023, they sold just about $639 million in February 2023.

- Two passive sectors getting inflows from FPIs on a net basis were IT and healthcare. IT saw net inflows of $128 million while the healthcare sector saw inflows of $113 million.

- Metals segment has seen aggressive selling of $319 million in February 2023 on account of weak metal prices and due to supply chain constraints leading to high input costs.

- The unprecedented slump in the stocks of Adani Group Companies was due to the release of Hindenburg Report, claiming irregularities.

Primary Market Update:

There were 0 main board IPOs in February, 2023 against 2 main board IPOs in January, 2023 as the markets turned to be bearish. There were 3 SME IPOs in February, 2023 as against 4 SME IPOs in January, 2023. The SME IPOs included of Transvoy Logistics India Limited, Earthstahl & Alloys Limited and Indong Tea Company Limited.

Funds Mobilization by Corporates (Rs. In Crore)

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket