Transaction:

- JK Paper Ltd. will acquire a 72% stake in Borkar Packaging Pvt. Ltd. for approximately Rs. 235 Crore for a cash consideration.

- The acquisition will involve purchasing 65.7% from existing shareholders and subscribing to fresh equity shares for the remaining 6.3%, while the balance 28% stake will be acquired over the next 4 years.

- Borkar Packaging’s enterprise value, including debt, was estimated to be between Rs. 350 Crore and Rs. 450 Crore by various news media.

About Borkar Packaging Private Limited:

- Established in 1994, Borkar Packaging is a leading Indian manufacturer of folding cartons, corrugated boxes, and labels with 7 manufacturing plants across Goa, Pune, Daman, Himachal Pradesh, Kolkata, and Puducherry.

- The company serves prominent clients such as Unilever, Nestlé, Colgate, Dabur, Alkem Laboratories, and Indoco Remedies.

About JK Paper Limited:

- Established in 1962, JK Paper, part of the Singhania family-led JK Group, is a market leader in office papers, coated papers, and packaging boards.

- The company operates three integrated manufacturing facilities with a total saleable capacity of 761,000 TPA and pulp capacity of 475,000 TPA, maintaining a strong presence in branded copier paper and packaging.

Rationale:

- The acquisition will strengthen JK Paper’s leadership in corrugated packaging, position it among the top three folding carton players in India, and expand its presence in the high-growth packaging segment while diversifying beyond paper.

- It will also enable JK Paper to leverage Borkar’s strong customer base and nationwide manufacturing footprint.

- The deal will enhance synergies with JK Paper’s existing corrugated and monocarton businesses and expand the company’s secondary and tertiary packaging portfolio, enabling cross-selling opportunities across segments.

- The acquisition taps into the strong growth potential of India’s packaging conversion sector, driven by demand from FMCG, pharmaceutical, and electronics industries, while helping offset pressures from rising wood costs and cheap imports.

- The deal is aligned with the company’s aggressive M&A strategy in high-margin packaging segments and is its fifth packaging acquisition in three years.

- The company previously acquired Horizon Pack, Securipax packaging, Manipal utility and Radheshyam Wellpack – all in the cartoon and corrugated packaging category.

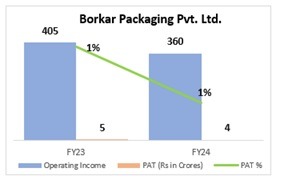

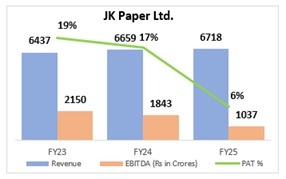

- In FY 2023-24, Borkar Packaging recorded revenue of Rs. 393.2 crore, while JK Paper posted consolidated turnover of Rs. 1,784.88 crore and profit after tax of Rs. 81.23 crore for the quarter ending June 2025.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.