by Vora Corporate Finance | May 20, 2021 | Financial Advisory, Insights, Private Equity & IPO

Transaction: Creador sold its stake in Ahmedabad based Corona Remedies to PE fund ChrysCapital. ChrysCapital paid Rs.6.7 billion ($90 million) for a 30% stake, of which 20% came from Creador and 10% from the promoter group. The deal values Corona Remedies at around...

by Vora Corporate Finance | Apr 17, 2021 | Financial Advisory, Insights, Merger & Acquisitions, Private Equity & IPO

Union budget was presented and was well received and Secondary markets touched all-time high in February 2021. IPOs of Indigo Paints Limited and Nureca Limited came in the month of February 2021 and were listed at high premiums. Key deals include Advent...

by Karan Vora | Apr 17, 2021 | Financial Advisory, Insights, Merger & Acquisitions, Private Equity & IPO

The New year 2021 has begun on a strong positive note with vaccination drives in major economies as well as in India. The COVID-19 incidence is seen receding and in terms of nominal GDP, 96 per cent of pre-pandemic economic activity has been restored. Key M&A and...

by Vora Corporate Finance | Jan 16, 2021 | Financial Advisory, Insights

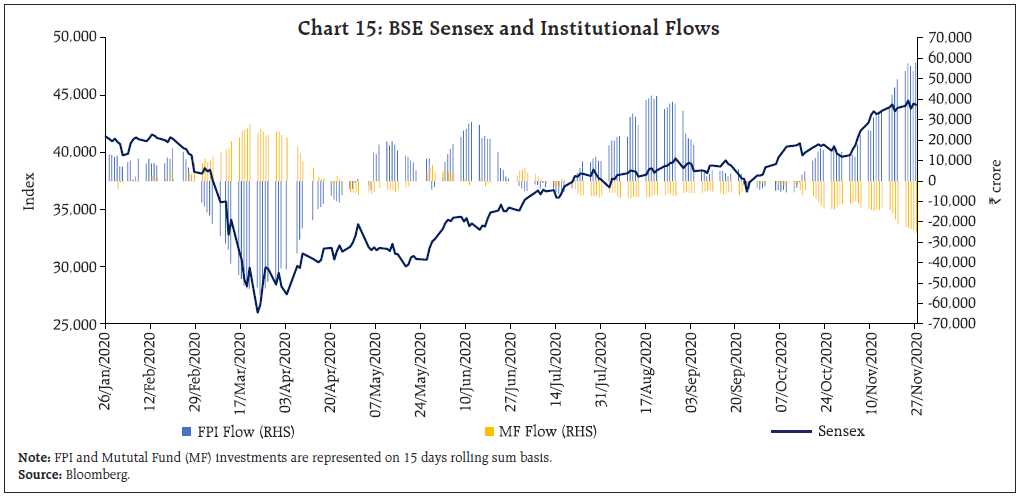

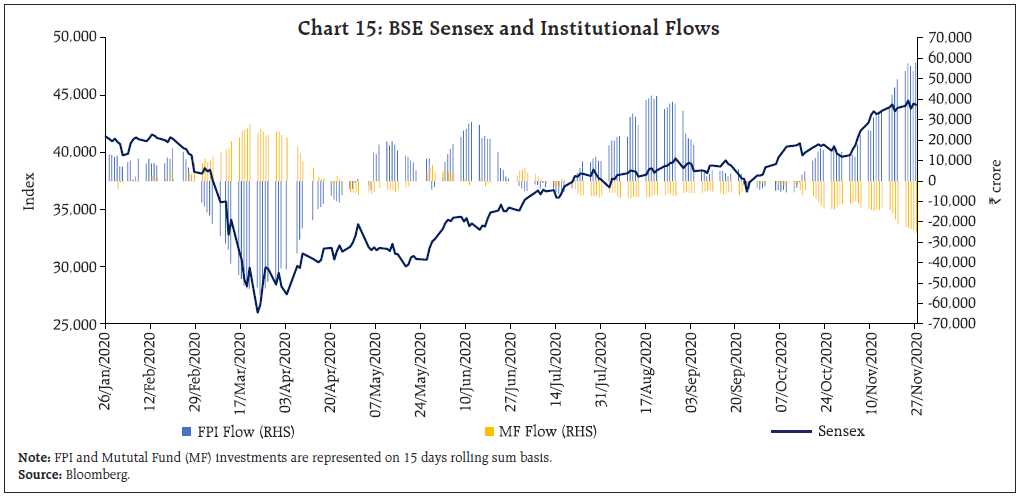

BSE Sensex went up by 11.45% in November 2020 to close at 44,150. Nifty 50 closed at 12,969 in November, higher by 11.40% from 39,614 in October closing. Expectation of quick arrival of Covid-19 vaccines, slowing of Covid19 infections, abundant liquidity, economic...

by Karan Vora | Sep 5, 2020 | Articles, Capital Market Updates

Read on about recent stock market rally and liquidity impact, post covid economic recovery and rational of RIL JIO and FB deal in our capital market update published in CA Association Journal. Click here to download the full article in PDF...