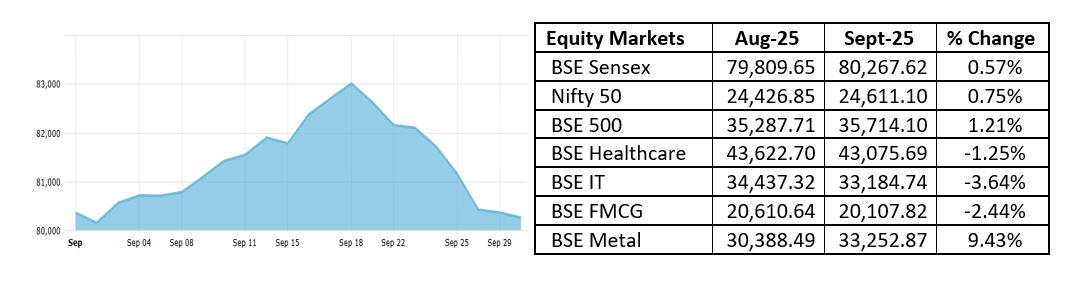

- The BSE Sensex closed at 80,268 up by 0.57%, and the Nifty 50 closed at 24,611 up by 0.75% in September 2025, supported by easing global yields and strong domestic inflows.

- India’s global market cap share fell to 3.5%, a two-year low from 4.6% in September 2024, as peers like China (+27%) and Korea (+23%) outperformed.

- FPIs withdrew Rs. 35,301 crores in September, taking year-to-date outflows to Rs. 2.53 lakh crore, driven by US tariff tensions and higher H-1B visa fees.

- DIIs remained net buyers, deploying a record Rs. 5.81 lakh crore YTD, supported by robust SIP inflows and strong insurance participation.

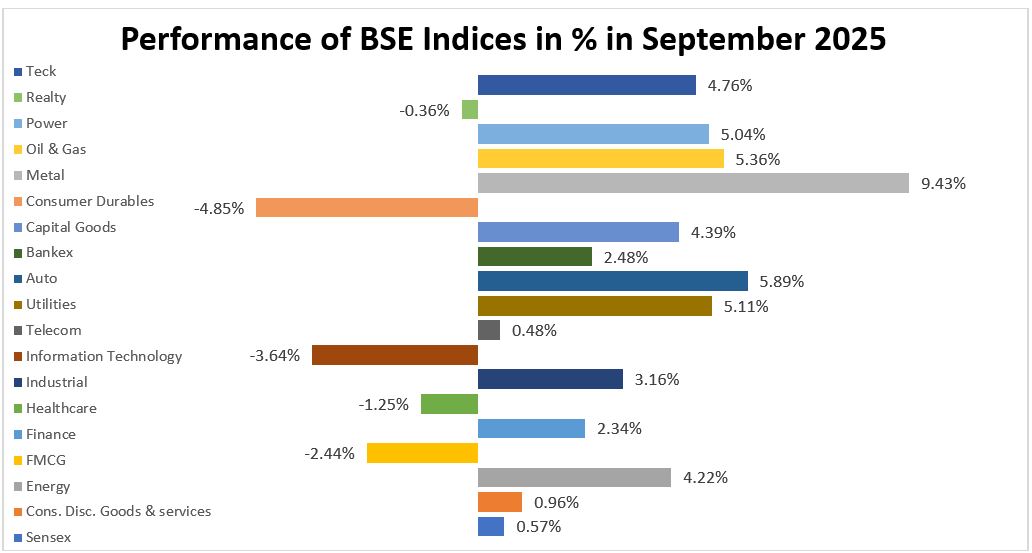

- FPIs rotated from defensives to cyclicals, trimming exposure in IT, Pharma, and FMCG while adding positions in Autos and Capital Goods.

- The BSE market capitalization held steady at Rs. 451.6 lakh crore, while Midcap and Small cap indices ended flat, reflecting near-term consolidation.

- The advance-decline ratio on the BSE stood at 2,052 advances against 2,042 declines, with 166 stocks remaining unchanged, reflecting cautious investor mood.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.