India’s Q2 Economic Momentum strengthens as Inflation hits record lows

Q2 FY26 Growth Performance

I India’s economy is estimated to have expanded by 7.3% in Q2 FY26, in line with growth of 7.8% in Q1. Growth during the quarter was driven by stronger rural spending, improved agricultural output and steady government expenditure, even as urban demand and private investment remained relatively soft. Some boost might have also come from front-loaded surge in exports as firms expedited shipments ahead of the US tariff hike to 50% in late August. Industrial activity showed strength, services recorded mixed performance, and agriculture was affected by episodes of unseasonal rainfall. Despite global uncertainties, tariff wars and trade-related pressures, India continues to remain the fastest-growing major economy in the world, supported by resilient domestic demand and sustained public investment.

Inflation Trends

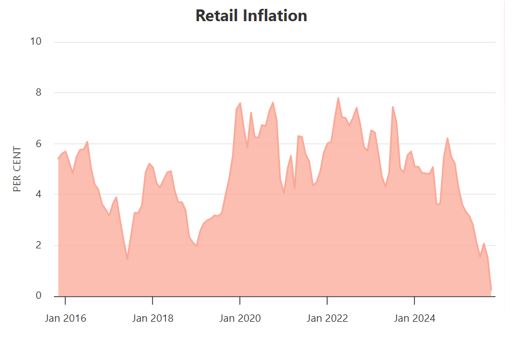

Retail inflation eased to a record low of 0.25% in October 2025, down from 1.54% in September, marking four consecutive months below the RBI’s 4% target. The decline reflects the full impact of GST cuts, a favourable base effect, and a steep 5% fall in food prices, the sharpest drop in over a decade. Prices of vegetables and pulses fell significantly, while core inflation remained stable at 4.3%, indicating steady underlying demand conditions.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.