BSE Sensex went up by 11.45% in November 2020 to close at 44,150. Nifty 50 closed at 12,969 in November, higher by 11.40% from 39,614 in October closing.

Expectation of quick arrival of Covid-19 vaccines, slowing of Covid19 infections, abundant liquidity, economic revival and hopes of end to Covid-19 pandemic are the key reasons for strong performance of market in November 2020.

Amongst the BSE sectoral indices almost all indices were strong performers in the month of November. Metal (24.51%), Bankex (23.72%) and Finance (22.58%) were the best performers and apart from Energy all other sectors are positive. Record breaking FPI inflow in November is key reason for outstanding performance in all sectors.

Record breaking FPI Inflows in November 2020:

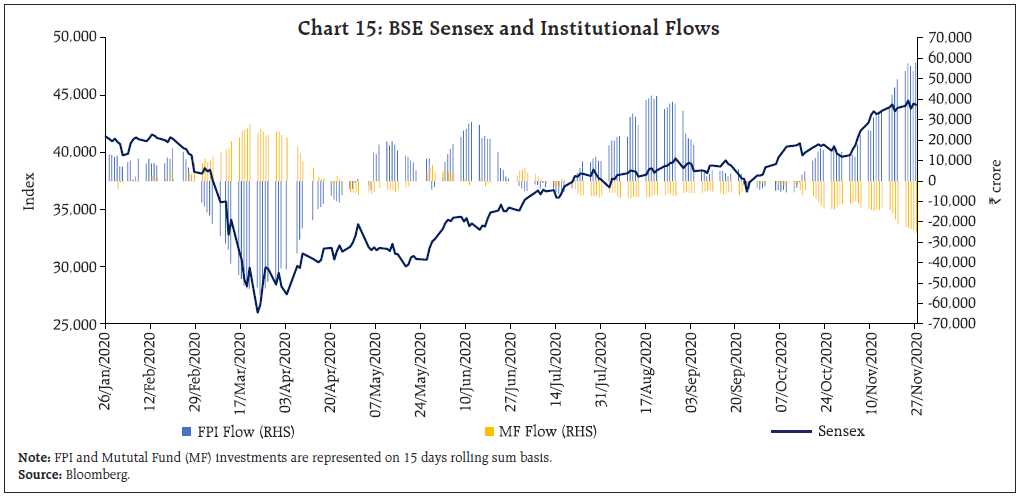

Foreign Portfolio Investors (FPI) infused highest ever Rs. 60,358 Crore in Indian equity markets in the month of November. FPI’s were net buyers in October as well. It shows that global investors have a strong preference for emerging market of India. FPI Inflows are one of the key drivers of Sensex as can be seen in following chart.

Acknowledgements: RBI Bulletin (www.bulletin.rbi.org.in), SEBI Bulletin (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.