Transaction:

- Ujala Cygnus, backed by PE firm General Atlantic announced a strategic partnership with Amandeep Hospitals to acquire a 60% controlling stake in Amandeep Hospitals, marking its entry into Punjab and expanding its presence in North India.

- According to certain media outlets, the deal value is estimated between Rs. 400–500 crore.

- The acquired hospitals will operate on an asset-light model, except for one or two units where Amandeep Hospitals already owns the building infrastructure.

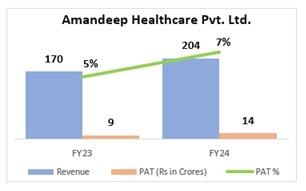

About Amandeep Hospitals:

- Founded in 1990 by Dr. Amandeep Kaur and Dr. Avtar Singh, the chain operates 5 super-specialty hospitals with 800+ operational beds in the Punjab and Jammu & Kashmir region.

- Key specialties include orthopaedics, cosmetic surgery, anaesthesia, oncology, neuro and spine surgery, joint replacement and general medicines.

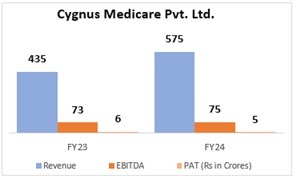

About Ujala Cygnus:

- Established in 2011, Ujala Cygnus runs hospitals across Tier-II and Tier-III cities in Haryana, Uttar Pradesh, Uttarakhand, J&K, and Delhi.

- Offers services across 30+ specialties with a team of over 300 doctors, focusing on quality care in underserved regions.

Rationale:

- The acquisition will expand Ujala Cygnus’ hospital network from 22 to 28 hospitals, increasing its total bed capacity from approximately 2,000 to nearly 2,800 beds.

- The deal consolidates Ujala Cygnus’ position as the largest private hospital network in the Jammu & Kashmir region.

- It marks Ujala Cygnus’ first foray into the Punjab healthcare market, adding five hospitals located in Amritsar, Pathankot, Firozpur, and Srinagar.

- The combined entity plans to deepen its presence in Punjab by exploring new facilities in Ludhiana, Jalandhar, Patiala, and the Tricity region.

- The group also aims to enhance its services by strengthening its focus on tertiary and quaternary care.

- In April 2024, General Atlantic PE firm acquired 70% stake in Ujala Cygnus valuing the hospital chain at an EV of Rs. 1600 Crores and providing a full exit to early investors including Eight Roads Ventures, Somerset Indus Capital, and Evolvence Capital.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.