by Vora Corporate Finance | Apr 20, 2024 | Insights, Private Equity & IPO

Transaction: Fintech-focused software-as-a-service firm Perfios secured $80 million in funding from Teachers’ Venture Growth (TVG), a late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan (OTPP). With the fresh investment, the Perfios becomes...

by Vora Corporate Finance | Apr 20, 2024 | Insights, Merger & Acquisitions

Transaction: Biocon Biologics Limited, a fully integrated global biosimilars company and a subsidiary of Biocon Limited, today announced a long term commercial collaboration with Eris Lifesciences to expand patient access to its portfolio of Metabolics, Oncology, and...

by Vora Corporate Finance | Apr 20, 2024 | Insights

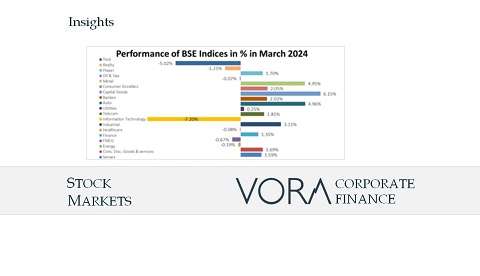

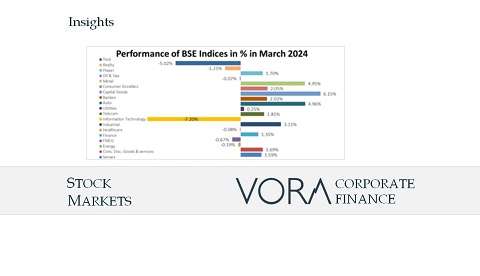

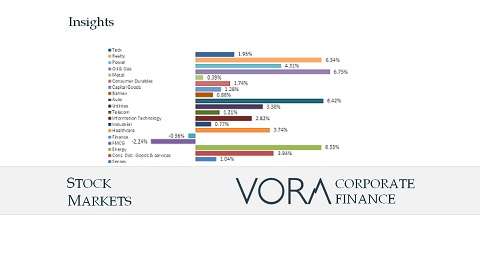

Secondary Market: The BSE Sensex closed at 73,651.35 up by 1.59% and the Nifty 50 closed at 22,326.90 up by 1.57% in March 2024. This market action indicates upside momentum in the market amidst range-bound action. Despite mixed cues, the market showed strength,...

by Vora Corporate Finance | Apr 20, 2024 | Insights

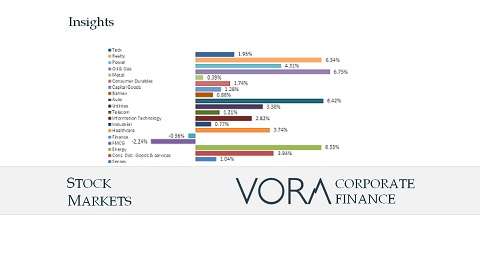

Secondary Market: The BSE Sensex closed at 72,500 up by 1.04% and the Nifty 50 closed at 21,983 up by 1.18%. Foreign investors continued their bullish stance on India’s debt market with investment of around Rs. 22,500 Crore in Indian debt market supported by India’s...

by Vora Corporate Finance | Apr 20, 2024 | Insights

Economic Update: The Indian economy grew by 8.4% during the October-December quarter of the current financial year 2023-24, outshining all forecasts. India’s economic growth during the December quarter has emerged as a surprise for economists who were expecting a...