Insights

Our take on developments in Economics, Stock Markets, Primary Market, Fund Raising, Debt, Private Equity and M&A deal Making.

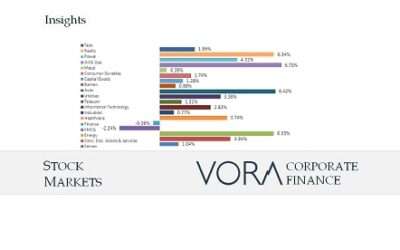

Stock Market Update: March 2024

Secondary Market: The BSE Sensex closed at 72,500 up by 1.04% and the Nifty 50 closed at 21,983 up by 1.18%. Foreign investors continued...

Economic Update: March 2024

Economic Update: The Indian economy grew by 8.4% during the October-December quarter of the current financial year 2023-24, outshining all...

PE: Convergent, Samara Capital to acquire 51.8% in Agro Tech Foods

Transaction: Convergent Finance LLP and private equity firm Samara Capital will jointly acquire a 51.8% stake in Agro Tech Foods Limited...

M&A: Eris Lifesciences Ltd acquires 51% stake in Swiss Parenterals for Rs. 637.50 Crores

Transaction: Eris Lifesciences Ltd., a leading Indian branded formulations company, today announced the expansion of its Sterile...

PE: Byjus plans to raise funds at discount

PE: Byjus to raise funds at a discount of over 90% from its previous valuation. Transaction: Beleaguered edtech startup Byju's is looking...

M&A: Sony terminates merger deal with Zee Entertainment

M&A: Sony terminates merger deal with Zee Entertainment Transaction: Sony pictures entertainment gave a statement confirming sending...