Economic Update:

- IMF said that the Global economic activity is experiencing a broad-based slowdown with inflation higher than seen in decades.

- The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook.

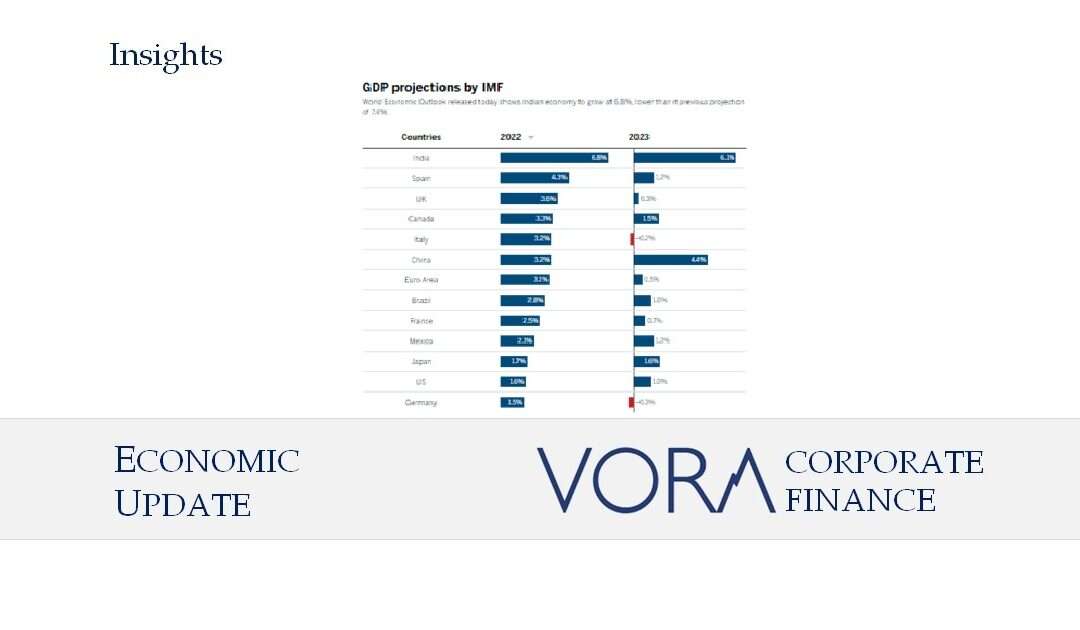

- However IMF commented that India has been doing fairly well in 2022 and is expected to continue growing fairly robustly in 2023.

- Fed hawkishness remained an issue for the markets. After the 75 basis points rate hike in September, the Fed now looks all set to hike rates by another 75 basis points in November 2022 and 50 basis points in December 2022.

COP27:

- The 2022 United Nations Climate Change Conference (UNFCCC), more commonly referred to as Conference of the Parties of the UNFCCC, or COP27, is the 27th United Nations Climate Change conference for governments to agree on steps to limit global temperature rise.

- Under the 1992 UNFCCC, every country is treaty-bound to avoid dangerous climate change and find ways to reduce greenhouse gas emissions globally in an equitable way.

- Global temperatures have risen by 1.1C and heading towards 1.5C, to prevent this 194 countries signed the Paris agreement in 2015.

- Finance has long been the talking point at this conferences. In 2009, developed countries committed $100Bn a year to developing countries to help them reduce the emissions and prepare for climate change. The target has been missed and pushed to 2023.

- The COP27 Egyptian presidency aims to radically accelerate the delivery of countries’ climate pledges, as pressure mounts on developed countries to provide more climate finance and on large developing countries to move away from polluting fuels like coal.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket