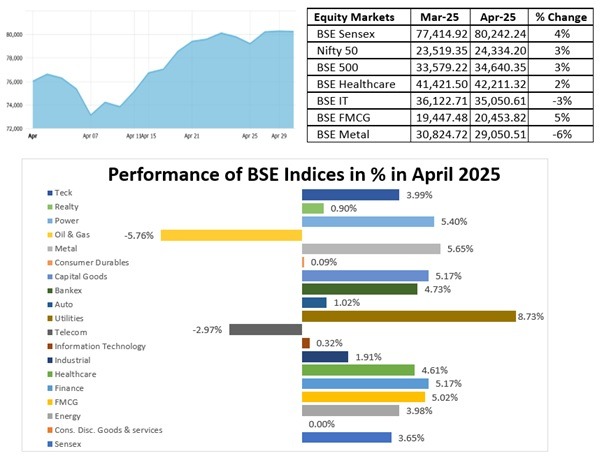

- The BSE Sensex closed at 80,242 up by 4% and the Nifty 50 closed at 24,334 up by 3% in April 2025 amid sustained foreign fund inflows and robust corporate earnings.

- The market was buoyed by optimism the potential India-US trade deal and record high GST collection in April 2025.

- Foreign investors became net buyers in April, investing Rs. 4,223 Crore in Indian equities for the first time in three months, reversing the trend of earlier outflows.

- The shift was driven by positive global cues, expectations of a US-India trade deal, a weakening US dollar, and a strengthening Indian rupee, which boosted the appeal of Indian assets.

- Strong quarterly earnings from top Indian companies supported sentiment, though FPIs pulled out Rs. 13,314 Crore from the debt general limit and Rs. 5,649 Crore from the debt voluntary retention route.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.