Transaction:

- Torrent Pharmaceuticals has signed definitive agreements to acquire a controlling stake in JB Chemicals and Pharmaceuticals at an equity valuation of Rs. 25,689 Crore on a fully diluted basis.

- The deal will be executed in two phases:

- Acquisition of 49.19% stake (46.39% from KKR and 2.80% from employees) for Rs. 12,636 Crore at Rs. 1,600/share, triggering a mandatory open offer for 26% at Rs. 1,639.18/share (Rs. 6,842.8 crore)

- Followed by a merger, under which JB Pharma shareholders will receive 51 Torrent shares for every 100 JB shares held.

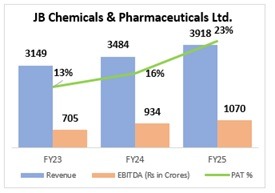

About JB Chemicals & Pharmaceuticals Limited:

- JB Pharma is a fast-growing Indian pharmaceutical company with leadership in hypertension and chronic therapies, featuring six brands among the top 300 in the Indian Pharmaceutical Market (IPM). It is also a leading CDMO player in medicated lozenges.

- The company has a strong international presence across over 40 countries, including key markets like Russia, South Africa, and the USA, supported by eight globally certified manufacturing facilities.

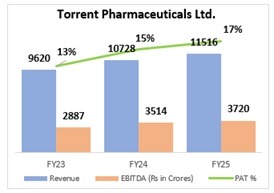

About Torrent Pharmaceuticals Limited:

- Incorporated in 2009 Torrent Pharma is a leading Indian pharmaceutical company focused on chronic and sub-chronic therapies, with a strong domestic presence and global operations across Brazil, Germany, and the US.

- The company has a proven track record of strategic acquisitions, including Elder Pharma, Unichem Labs, and Curatio Healthcare, and continues to build on a foundation of innovation and patient-centric growth.

Rationale:

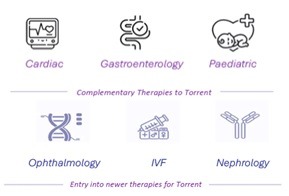

- The acquisition strengthens Torrent’s market position in the Indian pharmaceutical market by adding JB Pharma’s chronic care brands and expanding into new areas like ophthalmology.

- It provides Torrent with a strategic entry into the CDMO (Contract Development and Manufacturing Organization) segment, offering long-term growth potential.

- The combined operations are expected to deliver significant operational synergies across manufacturing, R&D, marketing, and distribution.

- JB Pharma’s global footprint in regions like Russia and South Africa will complement Torrent’s existing international operations.

- With the merger, the combined entity is expected to generate over Rs. 13,000 crore in annual revenue, enhancing its scale and competitiveness.

- This transaction will make Torrent Pharma the second most valuable pharmaceutical company in India, reinforcing its leadership in the sector.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.