Global Tariff Surge and Policy Shifts

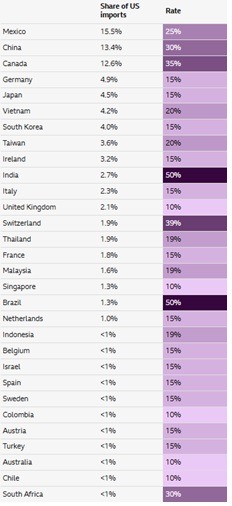

- US President Donald Trump has again initiated escalation of global tariffs, raising the average US import duty to 18.3% from 2.4% when he took office. His “reciprocal” tariff framework links rates to trade balances and security partnerships.

- As a result, allies such as Japan and the European Union now face 15% duties, while Brazil and India are targeted at steep 50%.

- In addition, sector-specific tariffs—such as 50% on steel, aluminium and copper—are amplifying the impact across industries.

- While Trump maintains that these measures protect US jobs and reduce trade deficits, economists caution that the burden largely falls on American importers, increasing consumer costs and fuelling inflation.

- Separately, Trump also declared that he will introduce significant tariffs on companies dealing with Russia, if deal to end Russia-Ukraine war was not reached soon.

Economic Consequences and Global Response

- The Yale Budget Lab estimates that US consumer prices will rise by 1.8% in 2025.

- Industries dependent on imported components, from automobiles to electronics, are already facing higher production costs, while global supply chains are coming under strain.

- The IMF and OECD have downgraded their forecasts for global growth, warning of weakened investment sentiment and prolonged trade uncertainty.

- Many nations have refrained from imposing retaliatory tariffs to avoid jeopardising access to the US market, instead accepting elevated duties in return for concessions. Only China and Canada have implemented significant countermeasures.

India – US Trade Flashpoint

- India, the United States’ ninth-largest trading partner with bilateral trade valued at $212 billion in 2024, is now subject to a 50% tariff following its decision to continue importing Russian oil. The measure, implemented despite recent trade discussions and cordial diplomatic exchanges, represents a significant setback in bilateral economic relations.

- PM Narendra Modi termed the move unfair and unjustified, stating that the government will take steps to safeguard the interests of farmers and the dairy industry.

- Analysts warned that the escalation could disrupt ongoing negotiations, erode India’s export competitiveness, and weaken its positioning as a manufacturing hub alternative to China.

- The development also signals a broader shift in Washington’s trade approach – from strategic friend-shoring towards a more assertive economic onshoring policy.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.