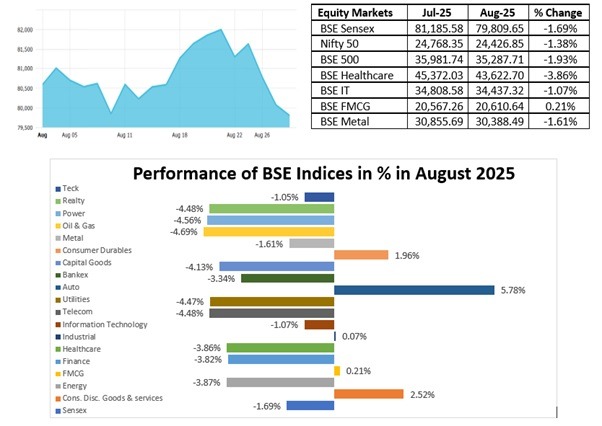

- The BSE Sensex closed at 79,809 down by 1.69%, and the Nifty 50 closed at 24,427 down by 1.38% in August 2025, as tariff-related concerns and weak global cues continued to dampen investor sentiment.

- The financial services index dropped 4.1% during the month, dragging the benchmarks lower, while FMCG, Media, and Consumer Durables indices posted modest gains.

- The advance-decline ratio on the BSE stood at 1,890 advances against 2,187 declines, with 160 stocks remaining unchanged, reflecting broad-based market weakness.

- FPIs recorded outflows of $4 billion in August, the highest in seven months, with heavy selling in financials, IT, and oil & gas, while selective buying was seen in telecom, autos, capital goods, and construction.

- In contrast, telecom, autos, construction, capital goods, and services sectors attracted FPI inflows on improved earnings visibility and strong demand outlook.

- Domestic institutional investors (DIIs) infused Rs. 94,829 crores into equities in August, the second-highest monthly inflow on record, supported by robust SIP flows from retail investors.

- India underperformed global peers, with the Nifty 50 up only 4.6% in 2025 so far, compared to gains of 18% in emerging markets and 17% in Asian markets.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.