Transaction:

- GKHSL acquired 100% of the equity share capital of Parekhs Hospital Private Limited, based in Ahmedabad, for a consideration of Rs.79 crore, comprising 2,55,000 equity shares of Rs. 10 each, making it a wholly owned subsidiary of the Company.

- The acquisition was funded through proceeds from the company’s successful Rs. 250.80 crore IPO in December 2025 and was undertaken pursuant to the objects of the issue as disclosed in the IPO prospectus.

About Parekhs Hospital:

- Founded in 1967 by Dr. Ramesh Parekh, is a distinguished multi-speciality healthcare institution headquartered in Ahmedabad, Gujarat, with more than 55+ years of clinical excellence and patient-centric care.

- It offers a comprehensive range of healthcare services spanning orthopaedics (joint, knee, hip, shoulder and elbow replacement), arthroscopy and sports injury treatment, trauma care, spine treatment, urology, gastroenterology, gynaecology, ENT, general surgery and more, all delivered with an emphasis on quality, accessibility and ethical patient care.

About Gujarat Kidney & Super Specialty Hospital (GKSSH):

- Incorporated in 2019 and renamed Gujarat Kidney & Super Speciality Hospital Limited in 2023, GKSSH is a Vadodara-based super speciality provider with 355 approved beds (250 operational) and advanced ICUs, operating theatres, diagnostics, and 24×7 emergency services.

- The Company runs a network of seven multi-speciality hospitals and four in-house pharmacies across Gujarat, offering secondary and tertiary care including surgery, orthopaedics, trauma, cardiology, nephrology, urology, gastroenterology, obstetrics, and minimally invasive procedures.

About Advisors:

- Incorporated in 2011, Vora Corporate Finance is the largest Mid-Market Investment Bank based out of Gujarat specialising in M&A, private equity, and fund raising.

- The firm has concluded over 60+ M&A, PE and fund-raising transactions including Acquisition of Atlas Life Sciences Pvt. Ltd. by Asahi Songwon Ltd., Restructuring of Rubber King Tyre p. ltd., M&A deal of Midas Sanitaryware Pvt. Ltd., advisory to EzDI Solutions India in its acquisition by AGS Health partners, Private Equity in Shree Orthocare pvt. Ltd., fund raising by Monosteel India Ltd. amongst others.

Rationale:

- The transaction aligns with the GKSL’s strategy to expand its presence in Gujarat and strengthen its portfolio of specialised healthcare services with aim to invest in established healthcare facilities, leveraging their existing patient base, staff, infrastructure and line of specialization/ operations, which is synergistic and complements its existing line of operations.

- Parekhs Hospital Pvt. Limited has performed several complex surgeries, won several awards and is operational since more than 5 decades and will be immediately value accretive to top line.

- This acquisition gives GKSL an immediate footprint in the metropolitan city of Ahmedabad positioning the company at the heart of the region’s medical tourism and industrial growth bypassing the multi-year gestation period required for greenfield developments. GKSL can leverage its experience of integrating multiple hospitals and offer newer speciality like robotics knee surgery.

- This acquisition aligns with GKSL’s growth strategy of inorganic growth and complements its existing portfolio made up of several strategic acquisitions across central Gujarat including Gujarat Multispecialty Hospital (Godhra) & Gujarat Kidney Hospital (Vadodara) via business transfer in FY24, and acquisitions of Surya Hospital & Gujarat Surgical Hospital (Sept 2024) and Ashwini Healthcare (March 2025).

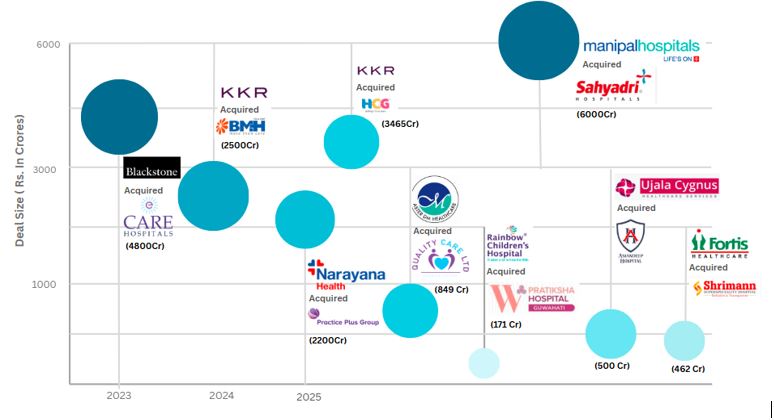

Recent Deal Updates in the Hospital Sector:

- Investment activity in the healthcare sector remains strong with focus on healthtech, wellness and pharma services, with a clear shift towards early and mid-stage deals and scalable digital health business models.

- India’s hospital market is registering strong growth on account of enhanced healthcare investments, government initiatives, and rising demand for high-class healthcare facilities.

- Hospital chains are increasingly focusing expansion strategies on tier-two and tier-three cities to capture growing healthcare demand in these emerging markets. Rising income levels, improving health awareness, and increasing health insurance penetration in smaller cities are creating attractive opportunities for organized healthcare delivery.

- Some notable deals in Hospital sector include, Narayana Health acquiring 100% equity of UK-based Practice Plus Group Hospitals from Bridgepoint for £188.78 million (₹2,200 crore). In October 2025.

(Link to the detailed article: https://vorafin.com/insights/ma-narayana-health-acquires-uks-practice-plus-group-hospitals-for-rs-2200-crore/) - In September 2025, Aster DM Healthcare acquired an initial 5% stake in Quality Care India Ltd. (QCIL) from Blackstone and TPG, involving the acquisition of 19 million QCIL shares for approximately Rs. 849 crore in exchange for 18.6 million Aster shares. (Link to the entire article: https://vorafin.com/insights/ma-blackstone-backed-care-hospitals-signed-definitive-agreement-for-merger-with-dm-aster-healthcare/)

- In August 2025, Rainbow Children’s Hospital Limited acquired a 76% controlling stake in Pratiksha Women & Child Care Hospital, Guwahati, at an enterprise value of ₹171 crore. (Link to the entire article: https://vorafin.com/insights/ma-rainbow-childrens-medicare-acquires-76-stake-in-pratiksha-hospital-for-rs-171-crore/)

- In July 2025, Manipal Hospitals entered into a definitive agreement to acquire a controlling stake in Sahyadri Hospitals from Canada’s Ontario Teachers’ Pension Plan Board (OTPP) in a transaction valued at around Rs. 6,000 crore. (Link to the entire article: https://vorafin.com/insights/ma-manipal-hospitals-acquires-sahyadri-hospitals-at-an-enterprise-value-of-rs-6000-crore/)

- In April 2025, Ujala Cygnus, backed by PE firm General Atlantic, announced a strategic partnership to acquire a 60% controlling stake in Amandeep Hospitals, marking its entry into Punjab with an estimated deal value of Rs. 400 to Rs. 500 crore. (Link to the entire article: https://vorafin.com/insights/ma-ujala-cygnus-acquires-controlling-stake-in-punjab-based-amandeep-hospitals/)

- In February 2025, Fortis Healthcare Limited signed definitive agreements to acquire the 228-bed Shrimann Superspeciality Hospital in Jalandhar, Punjab for Rs. 462 crore through slump sale. (Link to the entire article: https://vorafin.com/insights/ma-fortis-to-acquire-jalandhars-shrimann-superspeciality-hospital-for-53m/)

- Private equity firms are also showing increased interest in large hospital chains and well as single-speciality segments such as eye care and IVF which now attract about 30% of private equity investments in healthcare.

- In September 2025, KKR completed its acquisition of a 54% controlling stake in Healthcare Global Enterprises (HCG) from CVC Capital Partners for Rs. 3,465 crore

- In July 2024, KKR acquired a 70% controlling stake in Baby Memorial Hospital (a multi-specialty hospital chain in Kerala) in a deal reported at Rs2,000–2,500 crore. (Link to the entire article: https://vorafin.com/insights/pe-kkr-acquires-controlling-stake-in-baby-memorial-hospital/)

- In May 2023, global private equity firm Blackstone signed a definitive agreement to acquire a 72.5% controlling stake in CARE Hospitals from TPG’s Evercare Health Fund at approximately ₹4,800 crore, valuing the hospital chain at an enterprise value of approximately ₹6,600 crore.

- The rapid deal making including high-value acquisitions by global giants like Blackstone and KKR signals a fundamental shift from a fragmented hospital market to a “platform-led” ecosystem. Looking ahead, the Indian hospital sector is projected to maintain a robust 11–12% CAGR, with increasing consolidation with large multi-specialities and super specialty hospital ruling the markets.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.