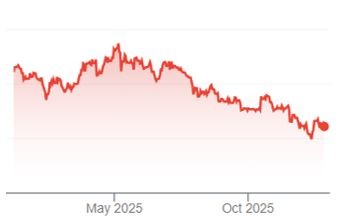

The Indian rupee slid to a record low on December 16, breaching the ₹91-per-dollar mark for the first time in intra-day trade, as sustained foreign portfolio investor (FPI) outflows, elevated hedging demand, and uncertainty over the India–U.S. trade deal weighed on sentiment. The currency is down about 5.3% year-to-date in 2025, its steepest annual decline since 2022, placing it among the weakest-performing emerging market and Asian currencies this year. Dealers attribute the move to persistent portfolio exits, tighter global financial conditions, and the impact of higher U.S. tariffs on Indian exports, which have pressured trade and capital flows.

Despite some improvement on the external balance, pressures remain uneven. India’s current account deficit narrowed to 1.3% of GDP in Q2, improving by nearly 90 basis points year-on-year, supported by services exports and remittances. However, the merchandise trade deficit widened to a record $41.7 billion in October, underscoring continued stress on the goods trade. The rapid depreciation—from Rs. 89 to Rs. 91 per dollar in under two weeks—has raised hedging costs, with the one-month dollar/rupee forward premium rising to about 23.25 paise, a seven-month high.

Market participants note that the RBI’s intervention has been relatively limited, suggesting tolerance for a weaker rupee to support export competitiveness amid ongoing trade negotiations and also probably an expectation that the Rupee will stabilize soon on its own in due time.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.