India Retains Fastest-Growing Economy Tag with 7.4% Q4 Surge, Set to Overtake Japan in 2025

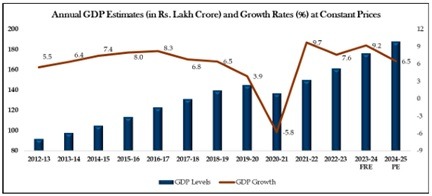

India’s economy maintained its momentum in FY 2024-25, clocking a robust real GDP growth of 6.5%, supported by an impressive 7.4% expansion in Q4. According to the IMF, India is poised to become the world’s fourth-largest economy by 2025, overtaking Japan.

Real GDP touched Rs. 187.97 lakh crore in FY25, up from Rs. 176.51 lakh crore in FY24. Nominal GDP soared to Rs. 330.68 lakh crore. In Q4 alone, real GDP rose to ₹51.35 lakh crore, compared to Rs. 47.82 lakh crore last year.

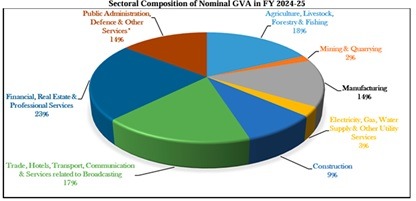

Sectoral performance was a key driver:

- Construction grew 10.8% in Q4, with 9.4% annual growth

- Public Administration & Defence rose 8.7% in Q4

- Financial & Real Estate Services increased 7.8% in Q4

- Primary Sector saw a Q4 rebound to 5.0%, compared to just 0.8% in Q4 FY24

Additionally, Private Final Consumption Expenditure grew 7.2%, while Gross Fixed Capital Formation surged 9.4% in Q4, reflecting robust demand and investment. India’s growth, despite external headwinds, underscores its rising economic stature on the global stage.

RBI Slashes Repo Rate by 50 bps to Spur Growth as Inflation Falls

On June 6, 2025, the Reserve Bank of India’s Monetary Policy Committee (MPC) reduced the repo rate by 50 basis points to 5.5%, marking the third consecutive cut this year. This move, prompted by a sharp decline in retail inflation to 3.2% in April, aims to stimulate economic growth. The RBI also cut the cash reserve ratio (CRR) by 100 basis points to 3%, injecting Rs. 2.5 lakh crore into the banking system.

Borrowers will benefit from lower EMIs on home and personal loans, while depositors may see reduced returns. The policy stance shifted from ‘accommodative’ to ‘neutral’ as the central bank retained its FY26 GDP growth projection at 6.5% and revised inflation down to 3.7%. Sectors like real estate, auto, FMCG, and infrastructure are expected to gain from improved liquidity and lower borrowing costs. However, volatility in the Indian rupee may impact IT exports due to currency fluctuations.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.