Transaction:

- Manipal Hospitals has entered into a definitive agreement to acquire a controlling stake in Sahyadri Hospitals from Canada’s Ontario Teachers’ Pension Plan Board (OTPP).

- The transaction is valued at Rs. 6000 crore, and is subject to regulatory approvals.

- OTPP is exiting its investment in Sahyadri Hospitals with approximately 2.6x times return on its original investment.

About Sahyadri Hospitals:

- Incorporated in 1996 and based in Pune, Sahyadri operates a network of 11 hospitals across key cities in Maharashtra.

- Offers a comprehensive range of specialties including cardiology, neurology, organ transplants, orthopaedics, gastroenterology, critical care, and maternal & child health

About Manipal Hospitals:

- Founded in 1991 and headquartered in Bengaluru, Manipal Hospitals is India’s second-largest healthcare provider, with a network of 38 hospitals, 10,500+ beds, across 19 cities.

- The group is backed by leading global investors, including Temasek Holdings (Singapore) and TPG Capital.

Rationale:

- This acquisition will strengthen Manipal’s presence in western India and make it a hospital chain of 49 hospitals with 12,000 beds across the country.

- Sahyadri operates through a diversified asset structure – three owned hospitals, three under long-term leases, two on short-term leases, and one flagship facility managed under an operation and maintenance (O&M) arrangement.

- The group’s hub-and-spoke model, with Pune as the hub for quaternary care and other locations as spokes for secondary and tertiary services, provides a scalable framework for Manipal to expand service reach.

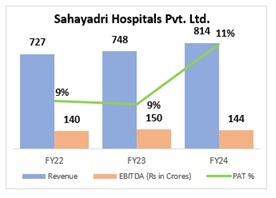

- Sahyadri Hospitals adds significant operational strength, having reported Rs. 814 Crore in revenue and Rs. 86 Crore in net profit for FY24.

- The partnership will bring together two well-established healthcare platforms, enabling collaboration in clinical quality, operational excellence, and access to broader patient populations.

- Ontario Teachers’ Pension Plan (OTPP), which acquired a majority stake in Sahyadri in 2022 and invested approximately Rs. 275 Crore, has supported the platform’s expansion and quality improvement efforts.

- Earlier in 2024, Sahyadri strengthened its regional presence by acquiring a controlling stake in Saideep Healthcare in Ahmednagar, highlighting its growth-focused approach.

- The transaction is consistent with Manipal’s strategy of expanding through selective acquisitions, building on its integration of Columbia Asia and AMRI Hospitals in recent years.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.