Transaction:

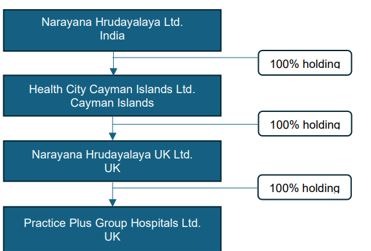

- Narayana Health, through its step-down subsidiary Narayana Hrudayalaya UK Ltd., acquired 100% equity of UK-based Practice Plus Group Hospitals from Bridgepoint for £188.78 million (Rs. 2,200 crore) in an all-cash deal.

- The transaction marks Narayana Health’s formal entry into the UK healthcare market, valued at 9.2x estimated FY25 EV/EBITDA on currently operational centres.

About Practice Plus Group Hospitals:

- Incorporated in 1997, Practice Plus Group operates 12 facilities in the UK, including 7 hospitals, 3 surgical centres, 2 urgent treatment centres, 3 musculoskeletal/diagnostic centres and 1 ophthalmology centre, with a total 330-bed capacity, specialising in orthopaedics, ophthalmology, and general surgery.

- The group performs 80,000 surgeries annually and generates £250 million in revenue, delivering a consistent 12% YoY growth over the past five years.

About Narayana Hrudayalaya Limited:

- Incorporated in 2000, the company operates 40 multi-specialty and super-specialty healthcare facilities across India and the Cayman Islands, including 19 hospitals, 2 heart centres, 18 clinics, and 1 hospital in the Cayman Islands, with a total of 5,789 operational beds.

- The group provides medical services across cardiac sciences, oncology, medicine & GI, renal, neurosciences, orthopedics, and other specialties, with a pan-India presence.

Rationale:

- The acquisition provides Narayana Health with entry into the UK healthcare market through 12 hospitals and surgical centres, including diagnostic and ophthalmology facilities.

- Narayana Health gains access to long-term NHS contracts, which contribute approximately 93% of Practice Plus’ revenue, ensuring stable and predictable cash flows.

- Practice Plus reported revenue of £250 million in FY25, up from £229 million in FY24, with adjusted EBITDA increasing from £16 million to £20 million, and profits showing similar growth.

- The acquisition expands Narayana Health’s presence in high-volume specialties such as orthopaedics, ophthalmology, and general surgery, which account for more than 50% of Practice Plus’ revenue.

- Practice Plus was previously acquired by Bridgepoint in 2010 as part of the Care UK healthcare division, providing an established operational platform.

- The deal aligns with UK healthcare trends, including a shift toward day-care procedures and higher private-pay penetration, where Practice Plus already has a strong presence.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.