There were 12 main board IPO in November including of Orkla India Limited, Studds Accessories Limited, Lenskart Solutions Limited, Billionbrains Garage Ventures Limited, Pine Labs Limited, Physicswallah Limited, Emmvee Photovoltaic Power Limited, Tenneco Clean Air India Limited, Fujiyama Power Systems Limited, Capillary Technologies India Limited, Excelsoft Technologies Limited and Sudeep Pharma Limited, against 17 main board IPOs in October 2025. There were 06 SME IPOs in November 2025 as against 27 SME IPOs in October 2025.

Sudeep Pharma Limited:

|

About the Company |

Incorporated in 1989, Sudeep Pharma Limited (SPL) manufactures excipients and specialty ingredients for the pharmaceutical, food, and nutrition industries, with a portfolio of 100+ products. The company operates three manufacturing facilities in Gujarat with an annual available capacity of 65,579 MT, along with an overseas manufacturing facility in Ireland. SPL was among the largest exporters of mineral ingredients from India by export volume in 2024 serving over 1,100 customers across approximately 100 countries, with repeat customers contributing over 78% of revenue in Fiscal 2025. The company employs 740 personnel and operates two R&D facilities as of June 30, 2025. The company reported revenue of Rs. 502 crore in FY25, up 9% from Rs. 459 crore in FY24, and posted a PAT of Rs. 139 crore compared to profit of Rs. 133 crore in the previous year. |

|

Funds Utilization |

The IPO proceeds from fresh issue will be utilized towards a capex for procuring machinery for the production line at Nandesari facility and general corporate purposes. |

|

Anchor Investors & Selling Shareholders |

The company raised Rs. 268.50 crore from anchor investors including SBI MF, HDFC MF, ICICI Prudential MF, Nippon India MF, Whiteoak Capital MF, Aditya Birla Sun Life MF, Motilal Oswal MF, Quant MF, Bandhan MF, UTI MF, Edelweiss MF, Tata AIA Life Insurance, and SBI Life Insurance, alongside individual investors like Mukul Agarwal and Prashant Jain, with selling shareholders includes promoters Sujit Jaysukh Bhayani, Shanil Sujit Bhayani, Avani Sujit Bhayani, and Sujeet Jaysukh Bhayani HUF. |

|

IPO Performance |

The Rs. 895 Crore IPO comprised of fresh issue of Rs. 800 Crore and OFS of Rs. 95 Crores. The issue was subscribed over 93.71 times, with QIBs subscribed the most at 213 times to the issue. Shares of Sudeep Pharma Limited made a stellar debut on the exchange, and got listed at Rs. 730 on NSE and Rs. 733.95 on BSE, i.e. a premium of 24% over the issue price of Rs 593. |

Gujarat Kidney & Super Speciality Limited:

|

About the Company |

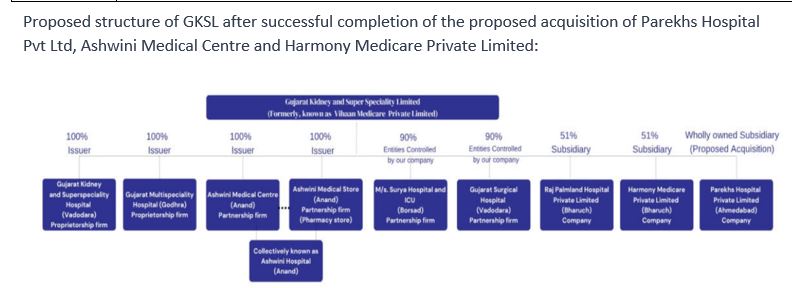

Incorporated in 2019, Gujarat Kidney and Super Speciality Limited (GKSSL) operates a regional chain of multispeciality hospitals offering services across orthopaedics, joint replacement, general and minimally invasive surgery, and obstetrics & gynaecology. On a consolidated basis, the company operates 7 multi-specialty hospitals and 4 in-hospital pharmacies across key cities in Gujarat. GKASSL has a total bed capacity of 490 beds, with approved capacity of 445 beds and operational capacity of 340 beds. The company has expanded its footprint through multiple acquisitions, strengthening its presence in Vadodara, Godhra, Bharuch, Borsad and Anand. As of June 30, 2025, GKASSL employed 89 doctors, 332 nurses and 338 other staff. The company had reported pro forma consolidated revenue of Rs. 120 crore, EBITDA of Rs. 29 crore, and net profit of Rs. 15 crore for FY25 (year ended March 31, 2025). |

|

Funds Utilization |

The IPO proceeds will be utilized for acquisitions including Parekhs Hospital and Ashwini Medical Centre, setting up a new Vadodara hospital, purchasing robotics equipment, repayment of borrowings, acquiring additional stake in Harmony Medicare Pvt. Ltd., and funding future inorganic growth and general corporate purposes. Vora Corporate Finance acted as exclusive financial advisor to Parekhs Hospital Pvt. Ltd. in its acquisition by Gujarat Kidney and Super Speciality Limited. |

|

Anchor Investors |

The company raised over Rs. 100 crore from anchor investors ahead of the IPO. |

|

IPO Performance |

The IPO comprised entirely of fresh issue of Rs. 250.80 Crore. The issue was subscribed over 5.21 times, with retail investors subscribed the most at 19.04 times to the issue. Shares of Gujarat Kidney & Super specialty Hospital Limited made a muted debut on the exchanges, and listed at Rs. 120 presenting a premium of approximately 6% over the issue price of Rs. 114. |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.