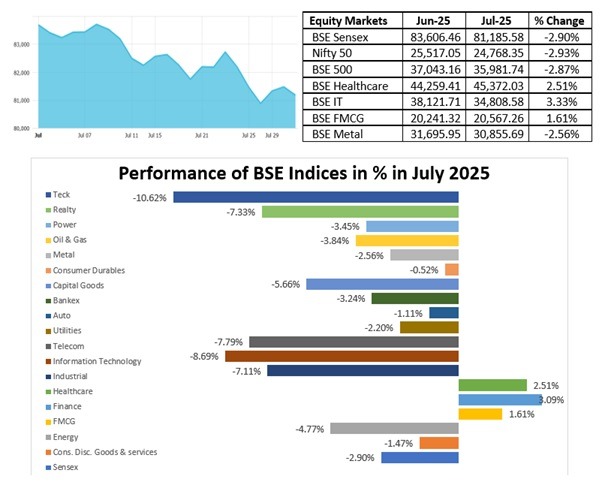

- The BSE Sensex closed at 81,186 down by 2.90%, and the Nifty 50 closed at 24,768, down by 2.93% in July 2025, driven by weaker-than-expected Q1 earnings heavy FPI outflows, and US–India trade tensions over a 25% tariff on Indian goods.

- Mid-cap and small-cap indices fell by 3.9% and 4.4% respectively, with most major indices slipping below their 50-day moving average.

- The advance-decline ratio on the BSE stood at 1,256 advances against 2,881 declines, with 162 stocks remaining unchanged, reflecting broad-based market weakness.

- Sectors such as FMCG, chemicals, and cement showed early signs of recovery, while the IT sector may benefit from a weaker rupee despite ongoing demand challenges.

- US President Donald Trump’s decision to impose a 25% tariff on Indian goods is expected to hurt export-oriented sectors such as pharmaceuticals, auto ancillaries, and select industrials, while also potentially impacting GDP growth and capital inflows if maintained for a prolonged period.

- Global sentiment was pressured as the US Federal Reserve kept interest rates steady at 4.25–4.50% and gave no clear signal of rate cuts, keeping the US dollar and bond yields elevated.

- India Inc.’s Q1 earnings have been mixed, with limited support to market sentiment. The IT sector continues to face demand-side pressures, while banks’ net interest margins have declined following the RBI’s rate cuts.

- Foreign portfolio investors sold equities worth approximately Rs. 42,000 crores during the month, while domestic institutional investors (DIIs) remained net buyers, partially offsetting the outflows.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.