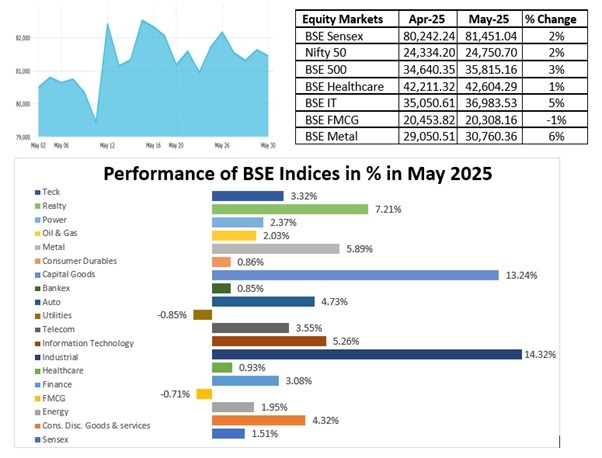

- The BSE Sensex closed at 81,451 up by 1.5% and the Nifty 50 closed at 24,750 also up by 1.7% in May 2025 driven by lower global interest rates, a stronger INR, and declining crude oil prices amid US-Iran détente.

- Capital Goods (+13%), Realty (+7%), and Metals (+6%) led sectoral gains, while FMCG was the only major BSE sectoral index to close in red.

- FIIs recorded net inflows of $1.57 billion in May, continuing the positive trend from April, while DIIs were strong net buyers with $7.92 billion in inflows, marking their 21st consecutive month of buying.

- GIFT Nifty posted a record monthly turnover of $102.35 billion, taking cumulative turnover since July 2023 to $1.93 trillion across 43 million contracts.

- On May 15, 2025, Indian markets rallied sharply on optimism over India-US trade ties, with the Sensex rising over 1,200 points and the Nifty closing above the 25,000 mark.

- However, on May 22, markets declined significantly due to negative global cues, with the Sensex falling by 644.64 points and the Nifty by 203.75 points, driven by concerns over US fiscal policy and rising treasury yields.

- Despite global uncertainties, the Indian equity market remained resilient, supported by improving macroeconomic indicators such as stable forex reserves, a revival in capital expenditure, and continued strength in mid and smallcap stocks.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.