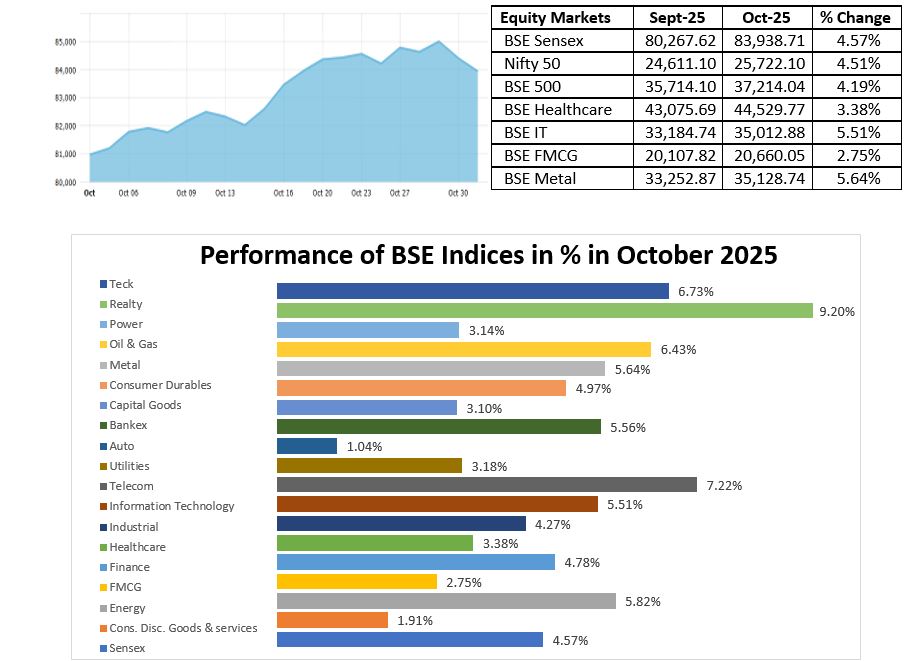

- The BSE Sensex closed at 83,939, up by 4.57%, and the Nifty 50 closed at 25,722, up by 4.51% in October 2025, supported by stronger earnings expectations, positive global cues, and renewed FII buying after three months of outflows.

- Investor sentiment was boosted by Q2FY26 results, with around 65% of Nifty companies beating estimates, an upgraded IMF growth forecast of 3.5% for India, and signs of stronger domestic activity.

- Markets also gained from optimism around a potential India–US trade agreement and rising expectations of US Fed rate cuts, global market gains of 3–5%, and softer US inflation at 3.2% YoY, supporting hopes of monetary easing.

- BSE Realty emerged as the top sectoral performer with a 9.2% gain, supported by strong FII interest, festive-season demand, favorable sentiment on interest rates, and lending reforms.

- BSE TECK rose 8.4%, benefiting from global tech rallies, persistent rate-cut expectations, and the Supreme Court’s relief to a major telecom player. supported by easing global yields and strong domestic inflows.

- Foreign and domestic institutional flows strengthened the market, with FIIs turning net buyers at USD 2.1 billion and DIIs adding USD 5.8 billion during the month.

- The advance-decline ratio on the NSE stood at 1,266 advances against 1,805 declines, with 109 stocks remaining unchanged.

- The Nifty’s forward P/E stood at 20-20.5x FY27E earnings, near its long-term average, supported by an expected 12–13% earnings CAGR over FY25–27.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.