by Vora Corporate Finance | Oct 15, 2022 | Financial Advisory, Insights

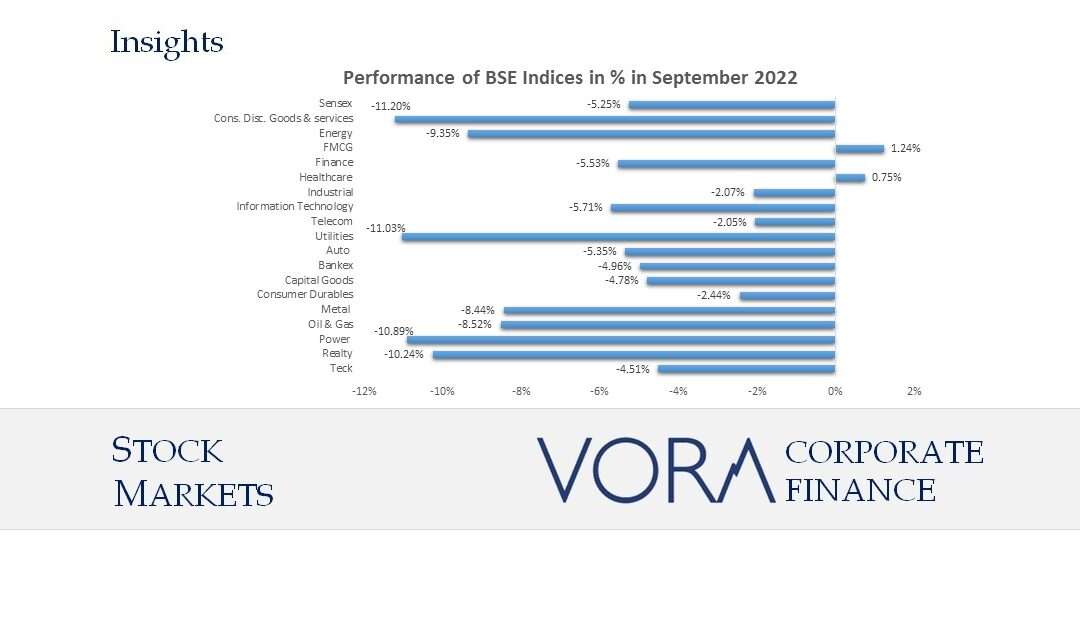

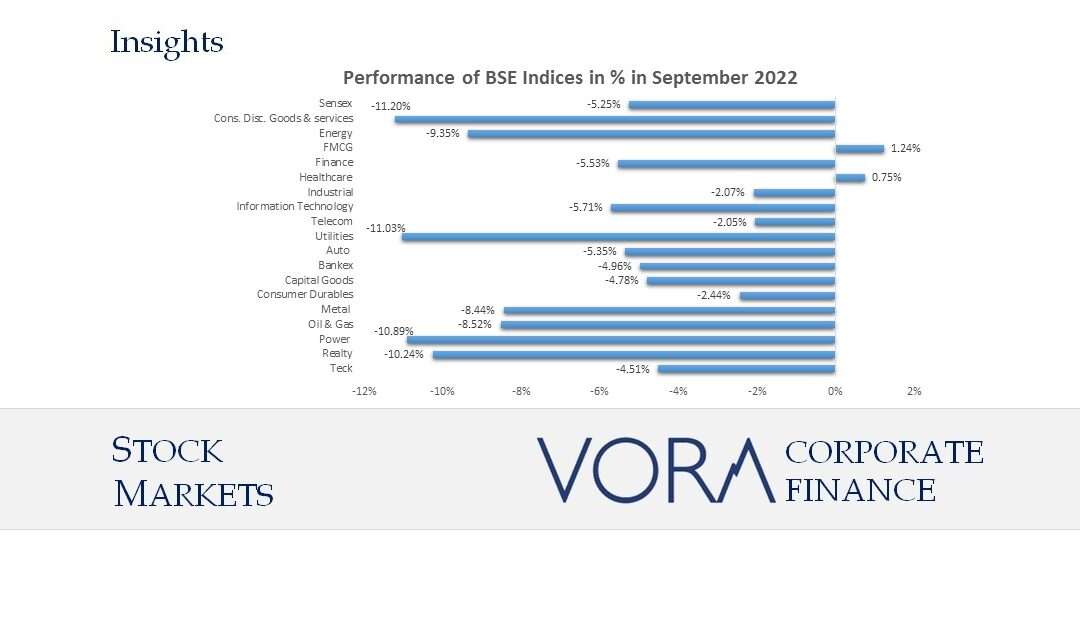

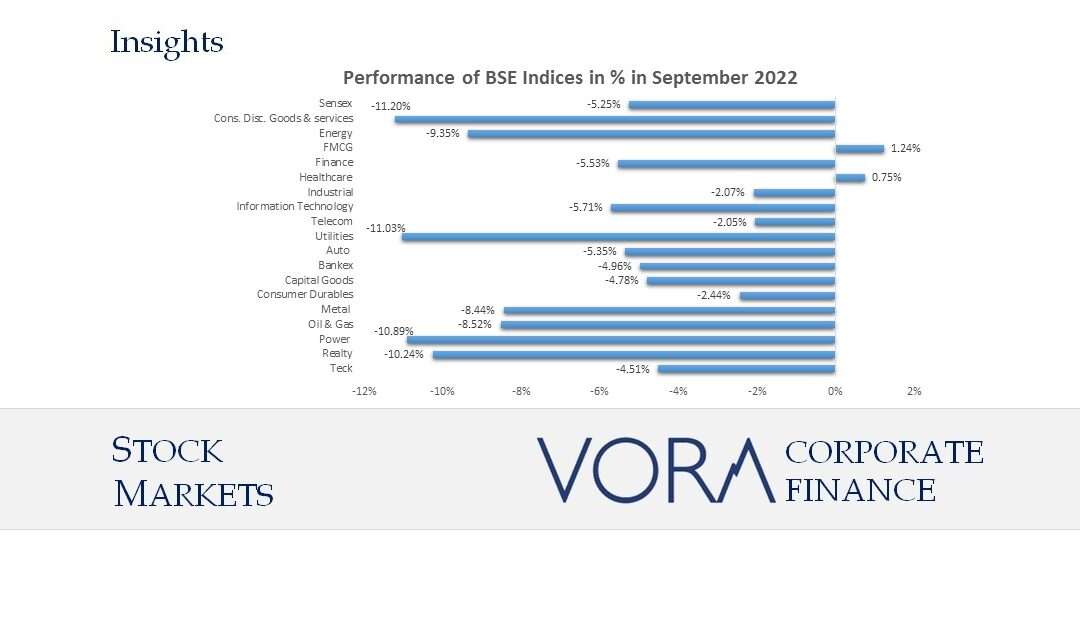

Trends in Secondary Markets: The markets tumbled during September 2022 with BSE Sensex falling around -5.25% to close at 56,409.96 and Nifty closing at 17,094.35. The domestic equity market remained low as the global cues remained unfavorable due to monetary...

by Vora Corporate Finance | Oct 15, 2022 | Insights

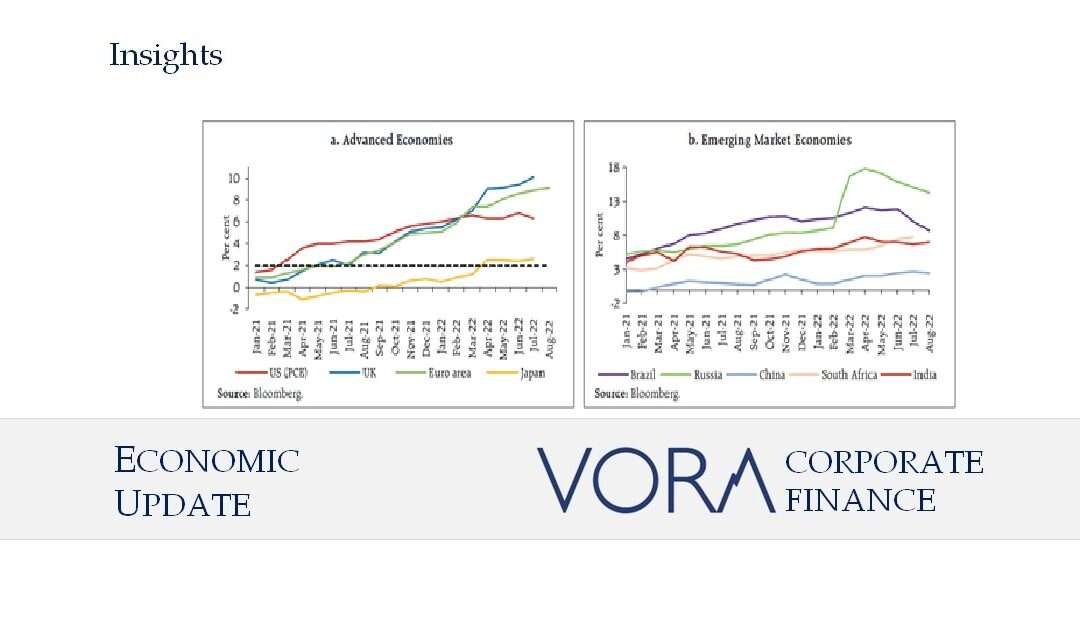

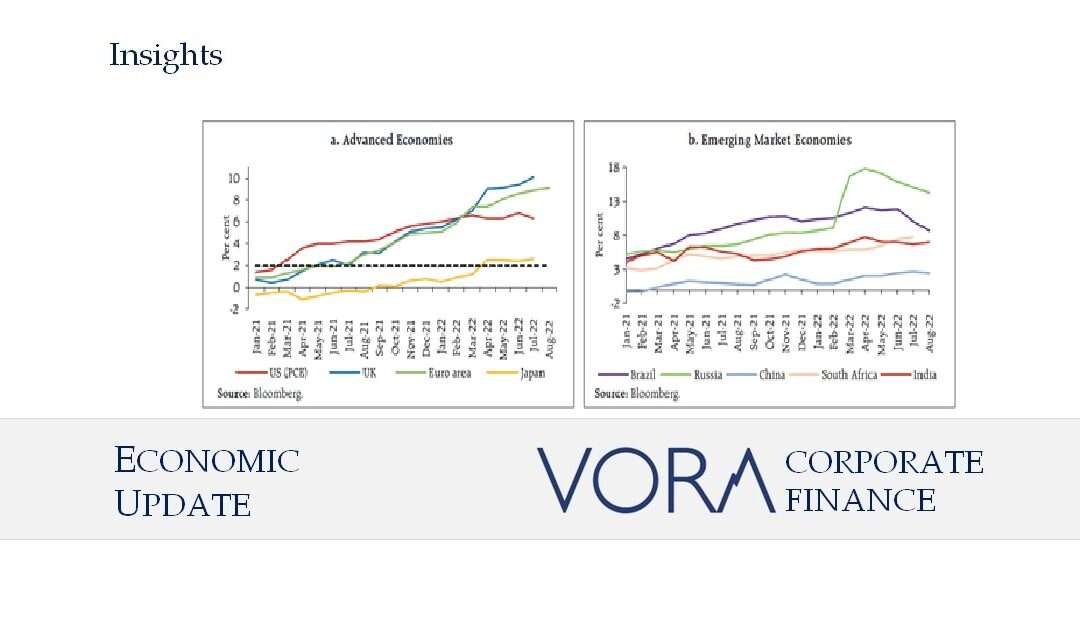

conomic Update: The RBI’s monetary policy committee raised the policy repo rate on September 30, 2022 by 50 bps a total of 190 basis point, its fourth hike in the current cycle, as India’s annual inflation rate came above the central bank’s target...

by Vora Corporate Finance | Oct 15, 2022 | Insights, Merger & Acquisitions

Transaction: Tata Steel announced amalgamation of six subsidiaries majorly owned by Tata Steel Limited into the parent company. The subsidiaries are all majority owned by Tata Steel and include Tata Steel Long Products Limited (74.91% equity holding), The Tinplate...

by Vora Corporate Finance | Oct 15, 2022 | Insights, Private Equity & IPO

Transaction: Tata Digital Limited invested nearly 30 Million USD in Tata 1mg. The transaction also facilitated 1mg to become India’s 107th Unicorn with a valuation of 1.25 Billion USD. 1 mg was acquired by Tata Digital Limited in June 2021. About 1mg: 1mg is India’s...

by Vora Corporate Finance | Sep 19, 2022 | Articles, Capital Market Updates, Merger & Acquisitions, Private Equity & IPO

RBI increased policy rate by further 50 bps to control inflation, at the same time, Inflation has eased for third month in row. Rupee hit all-time low and crossed 80 as US dollar is becoming stronger due to recession fears in Europe. Stock Markets have turned bullish...