by Vora Corporate Finance | Apr 1, 2022 | Insights, Merger & Acquisitions

Transaction: J.B. Chemicals & Pharmaceuticals Limited (JBCPL), a pharmaceutical company announced that it will acquire brands for the India market from Sanzyme Private Limited (Sanzyme), a player in the probiotics and reproductive health segment in the country....

by Vora Corporate Finance | Apr 1, 2022 | Insights

Russo Ukrainian Conflict: On the 24th of February, 2022, Russia launched a wide-ranged military attack on Ukraine. Russia announced that it had carried on a “special military operation” in eastern Ukraine to protect the people in the predominantly Russian-speaking...

by Vora Corporate Finance | Apr 1, 2022 | Insights

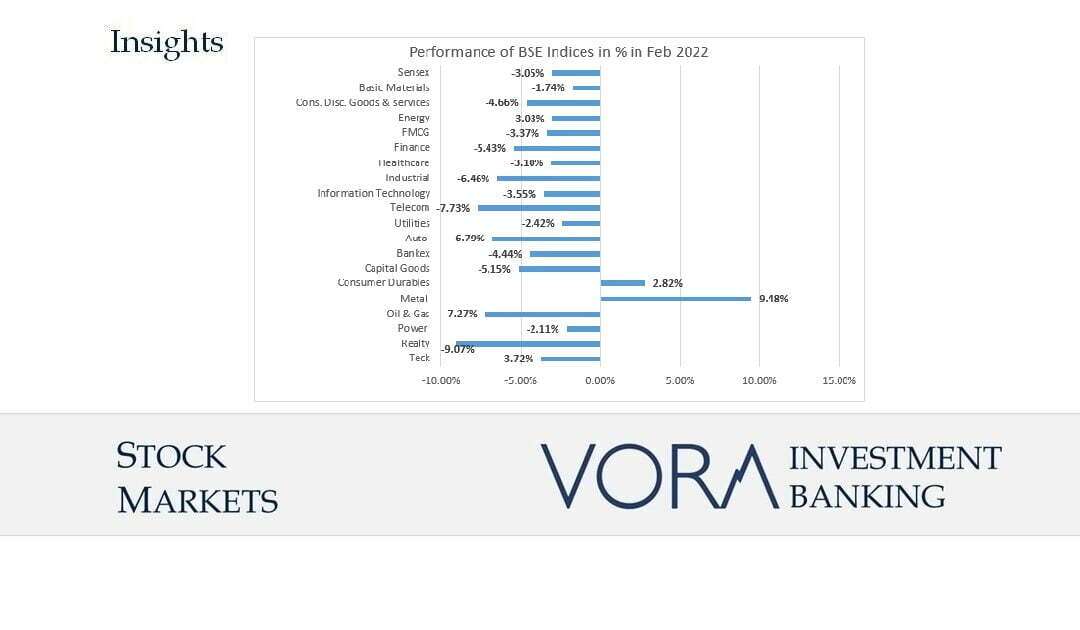

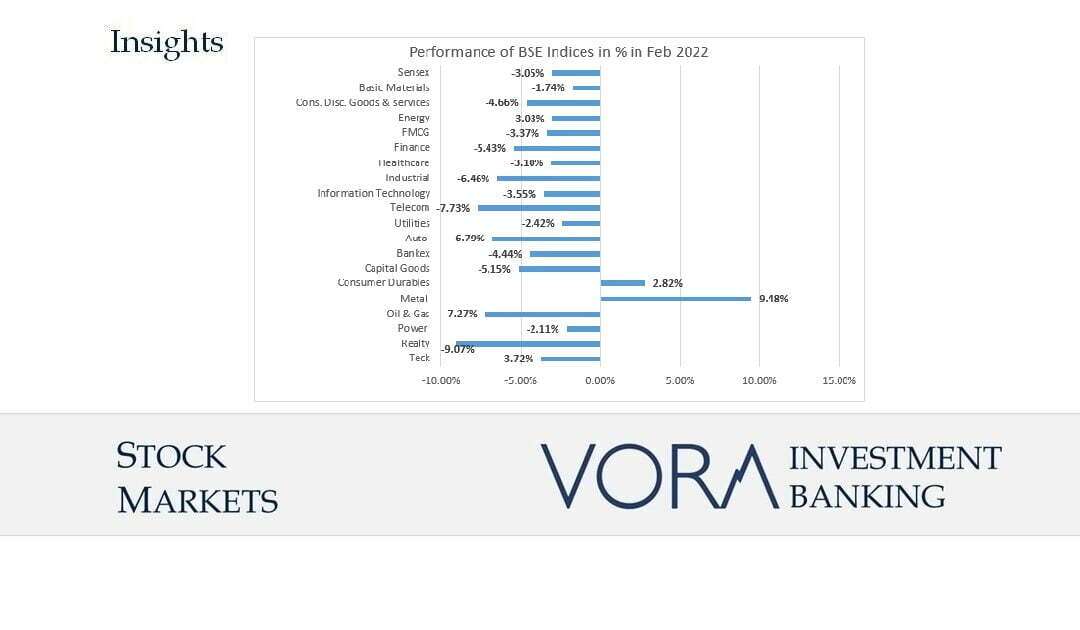

Trends in Secondary Markets: BSE Sensex went down by 3.05% to close at 56,247 in February 2022 as against 0.41% down to close at 58,014 in January 2022. Nifty 50 closed at 16,794 that was 3.15% lower as against 0.08% lower to close at 17,340 in January 2022. Indices...

by Vora Corporate Finance | Feb 24, 2022 | Insights, Private Equity & IPO

Transaction: Uniphore announced its Series E funding round of $400 million. This funding round brings Uniphore’s total funding to more than half a billion ($610 million). This round is led by NEA and raises the company’s valuation to $2.5 billion. March Capital and...

by Vora Corporate Finance | Feb 24, 2022 | Insights

BSE Sensex went down by 0.41% to close at 58,014 in January 2022 as against 1.73% up to close at 58,254 in December 2021. Nifty 50 closed at 17,340 which was 0.08% lower as against 2.18% high to close at 17,354 in December 2021. Sensex went up by around 848 points on...