Trends in Secondary Markets:

BSE Sensex went down by 3.05% to close at 56,247 in February 2022 as against 0.41% down to close at 58,014 in January 2022. Nifty 50 closed at 16,794 that was 3.15% lower as against 0.08% lower to close at 17,340 in January 2022. Indices were down primarily due to Russo Ukranian conflict and its effect on global supply chains.

Foreign Institutional Investors (FIIs) divested Rs.3,948 Crore while Domestic Institutional Investors (DIIs) invested Rs.4,142 Crore in the Indian equity markets in the month of February 22.

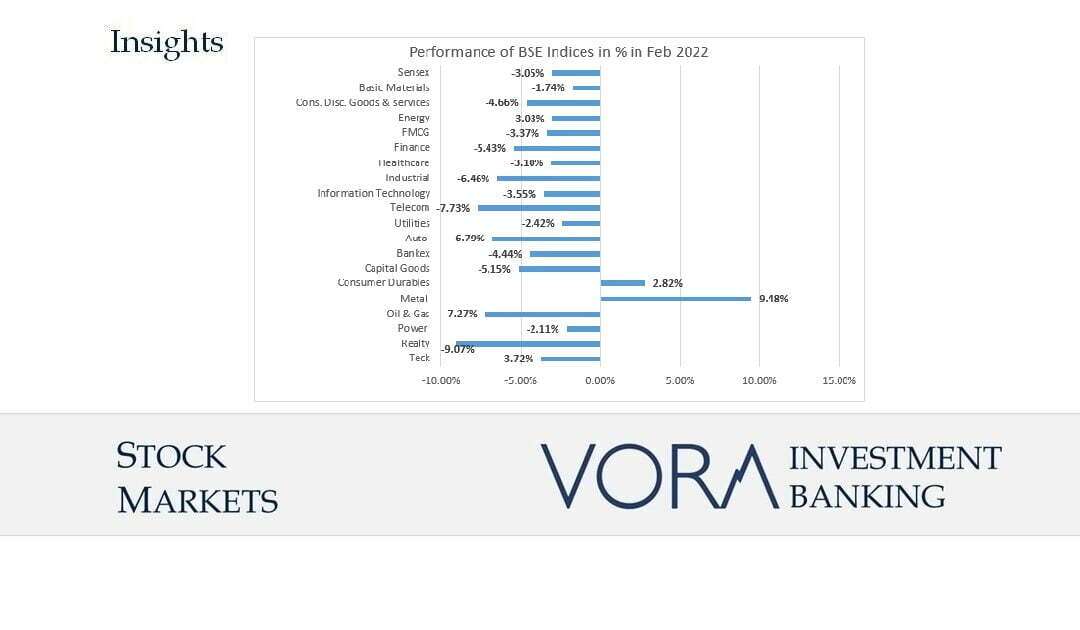

Majority of the BSE Indices were negative in the month of February. The highest decrease was in Realty

(-9.07%), Telecom (-7.73%), Oil and Gas (-7.27%) and others. Brent & energy prices are skyrocketing due to the full-scale war between Russia and Ukraine. Input costs for steam coal, coking coal, and ferro alloys are witnessing substantial rise which has resulted in higher prices of steel, nickel, zinc, etc. Hence the metal indice has gone up.

On account of the Russia-Ukraine war, the U.S. stocks also stumbled, with the S&P 500 falling 1%. Dow Jones fell 1.38% and Nasdaq lost 2.6% towards the end of February. Stock markets in Japan, Hong Kong, South Korea and Australia were down by up to 3%.

Primary market Update:

There were two mainboard IPOs of Vedant Fashions Limited and Adani Wilmar Limited in February 2022 as against one mainboard IPO of AGS Transact Technologies Ltd. in January 2022. There were four SME IPOs of Maruti Interior Products Limited, Safa Systems & Technologies Limited, Quality RO Industries Limited and Alkosign Limited in February 2022 as against one SME IPO in January 2022.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket #primarymarket #secondarymarket