Secondary Market:

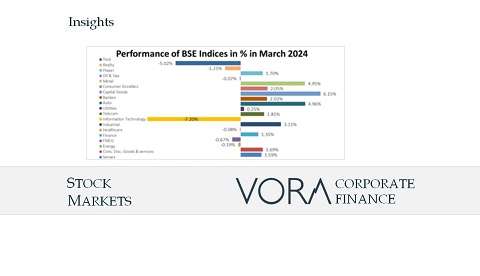

- The BSE Sensex closed at 73,651.35 up by 1.59% and the Nifty 50 closed at 22,326.90 up by 1.57% in March 2024.

- This market action indicates upside momentum in the market amidst range-bound action. Despite mixed cues, the market showed strength, particularly in the banking, energy, and auto sectors.

- Nifty has notched several record highs this financial year, surpassing 19,000 in June and reaching 20,000 and 21,000 levels in September and December, respectively. Further in January, it touched the 22,000 mark. Recently, on March 07, it recorded a new lifetime high of 22,525 points.

Primary Market Update:

There were 08 main board IPOs in March 2024 of Krystal Integrated Services Limited, Popular Vehicles and Services Limited, Gopal Snacks Limited, J.G. Chemicals Limited, R K Swamy Limited, Mukka Proteins Limited, Platinum Industries Limited, and Exicom Tele-Systems Limited as against 09 main board IPOs in February 2024. There were 05 SME IPOs in March 2024 as against 04 SME IPOs in February 2024.

Exicom Tele-Systems Limited:

|

About the Company |

Incorporated in 1994, Exicom Tele-Systems Limited specializes in power systems, electric vehicle charging, and related solutions. The company is among the first ones to enter India’s EV charger manufacturing segment. In this segment, the company occupies a share of 16% in the DC Power Systems market and 10% in the Li-ion based energy solutions. As of March 2023, it had a market share of 60% and 25% in the residential and public charging segments, respectively. The revenue of company decreased by 15% to Rs. 708 Crore in FY23 over FY22, but its PAT rose marginally. |

|

Funds Utilization |

Net proceeds from the IPO are proposed to be used for setting up of production lines at the planned manufacturing facility in Telangana, repayment of debt, investment in research and development and general corporate purposes. |

|

IPO Performance |

The IPO aimed to raise Rs. 429 Crore consisting of a fresh issue of Rs. 329 Crore and an offer for sale of Rs. 100 Crore by promoter Next Wave Communication. The price band was set at Rs. 135 to Rs. 142 per share. The IPO was over-subscribed by 130 times and the company made a strong debut on the stock exchanges with over 87% premium. |

Funds Mobilization by Corporates (Rs. In Crore)

|

Particulars |

Jan-24 |

Feb-24 |

|

I. Equity Issues |

9,134 |

20,869 |

|

a. IPOs (i+ii) |

3,419 |

7,684 |

|

i. Main Board |

2,956 |

6,920 |

|

ii. SME Platform |

463 |

764 |

|

b. FPOs |

0 |

0 |

|

c. Equity Rights Issues |

194 |

7,959 |

|

d. QIPs/IPPs |

3,255 |

3,400 |

|

e. Preferential Allotments |

2,266 |

1,826 |

|

II. Debt Issues |

63,371 |

83,137 |

|

a. Debt Public Issues |

2,190 |

1,861 |

|

b. Private Placement of Debt |

61,181 |

81,276 |

|

Total Funds Mobilized (I+II) |

72,504 |

1,04,006 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction