Secondary Market:

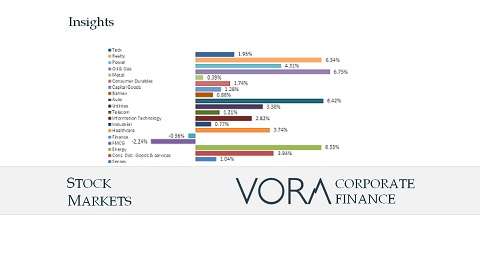

- The BSE Sensex closed at 72,500 up by 1.04% and the Nifty 50 closed at 21,983 up by 1.18%.

- Foreign investors continued their bullish stance on India’s debt market with investment of around Rs. 22,500 Crore in Indian debt market supported by India’s rising share in MSCI emerging market index and strong macroeconomic and corporate fundamentals.

- Indian bonds being included in the JP Morgan global bond indices also has a positive effect on the trend as this move is expected to bring substantial inflows of over $30 Billion in India over a period of 10 months. (We had covered this here: https://vorafin.com/insights/economic-update-october-2023/)

- The FMCG sector saw some correction, as companies except leading players reverted to their 10-year historical P/E, whereas auto and pharma sector saw further buying interest.

- Through the month of February 2024, the 10-year benchmark bond yields in India stayed between 7.00% and 7.10% through the month with little signs of volatility.

- The only volatility seen was in the immediate aftermath of the interim budget announcement because interim budget had pegged the FY25 fiscal deficit at just 5.1% of GDP, hinting at lower stress on the borrowing calendar.

Primary Market Update:

There were 09 main board IPOs in February 2024 of GPT Healthcare Limited, Juniper Hotels Limited, Vibhor Steel Tubes Limited, Entero Healthcare Solutions Limited, Capital Small Finance Bank Limited, Rashi Peripherals Limited, Jana Small Finance Bank Limited, Apeejay Surrendra Park Hotels Limited, and BLS E-Services Limited as against 04 main board IPOs in January 2024. There were 04 SME IPOs in February 2024 as against 08 SME IPOs in January 2024.

BLS E-Services Limited:

|

About the Company |

Incorporated in April 2016, BLS-E Services Limited is a digital service provider, the company’s service offerings can be categorized into three parts (i) Business Correspondents Services; (ii) Assisted E-services; and (iii) E-Governance Services. BLS E-Services Limited’s revenue increased by 150.31% to Rs 246.29 Crores and profit after tax by 277.94% to Rs 20.33 during FY2023. |

|

Funds Utilization |

The company proposes to utilize the Net Proceeds towards strengthening the technology infrastructure to develop new capabilities and consolidating the existing platforms; Funding initiatives for organic growth by setting up of BLS Stores; Achieving inorganic growth through acquisitions; and General Corporate Purposes. |

|

IPO Performance |

The initial public offer (IPO) of BLS E-Services was subscribed over 160 times at close, driven by strong interest from all the categories. The NII portion of the issue was subscribed the most at 300 times, followed by retail investors at 236 times and QIB part at 123 times. The shares made a bumper debut on Dalal Street as the shares got listed at a premium of 128.9% on BSE at Rs 309 as against the IPO price of Rs 135. On NSE, the stock listed at Rs 305, up 125.9%. |

Funds Mobilization by Corporates (Rs. In Crore)

|

Particulars |

Dec-23 |

Jan-24 |

|

I. Equity Issues |

41,372 |

9,134 |

|

a. IPOs (i+ii) |

9,534 |

3,419 |

|

i. Main Board |

8,932 |

2,956 |

|

ii. SME Platform |

602 |

463 |

|

b. FPOs |

0 |

0 |

|

c. Equity Rights Issues |

38 |

194 |

|

d. QIPs/IPPs |

15,613 |

3,255 |

|

e. Preferential Allotments |

16,187 |

2,266 |

|

II. Debt Issues |

1,10,090 |

63,371 |

|

a. Debt Public Issues |

2,014 |

2,190 |

|

b. Private Placement of Debt |

1,08,076 |

61,181 |

|

Total Funds Mobilized (I+II) |

1,51,462 |

72,504 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction