Economic Update:

- Monetary Policy Committee (MPC) of RBI at its meeting on August 5, 2022 decided to Increase the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points to 5.40 per cent with immediate effect. The standing deposit facility (SDF) rate was adjusted to 5.15 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.65 per cent.

- The MPC decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

- Consumer Price Index (CPI) Inflation eased for third month in a row to 6.71% in July 2022. While it is still more than the RBI’s upper limit of 6%, it is still a welcome relief. The inflation has eased as food and metal prices have come down. Crude Oil prices have also eased in recent weeks as global demand outlook is weakening.

- GST data for July was second highest ever at Rs. 1.49 lakh Crore. Finance ministry said that the GST data rose on back of economic recovery and measures taken to curb tax evasion.

- India’s core sector output growth was up 12.7% in June with coal, cement, electricity and refinery products growing strongly and natural gas, steel and fertilizers growing moderately.

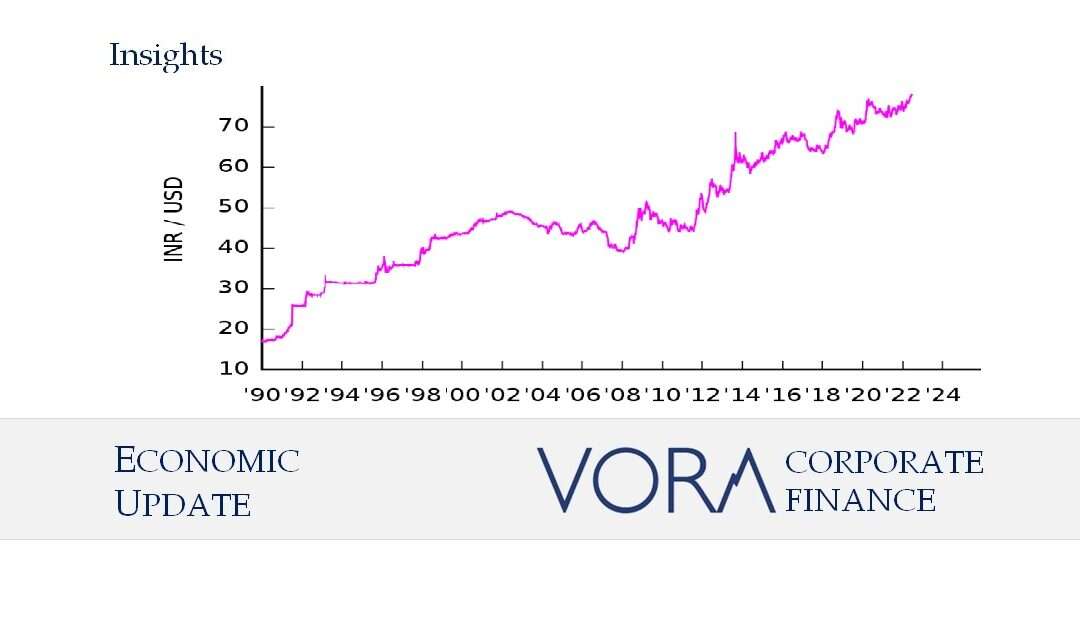

Rupee at 80 against USD:

- Rupee hit all-time low and breached the psychological mark of 80 per dollar in July 22 as dollar became stronger on account of recession fears and economic troubles in Europe. Investors are choosing US market over European markets due to recession fears.

- Europe is dealing with severe inflation which is hurting consumers and is ending post lockdown spending boon. Europe is also facing an energy crisis and political uncertainty and many economists are warning that a recession later this year is a possibility.

- Apart from underlying strength of the US Dollar, the foreign portfolio investments (FPI) equity outflows of last 9 months are also one of the reasons for depreciation in currency.

- However as FPI net inflows have again become positive in July, it should ease the depreciation pressure on the rupee.

- RBI had intervened heavily in the forex markets to make sure that there are no volatile swings in the currency market. RBI governor Mr. Das said that RBI was fine with rupee finding its level in line with the fundamentals but RBI will have zero tolerance for volatile and bumpy swings.

- Depreciating rupee impacts imports the most as imported items get more expensive. It also makes foreign education and foreign travel more expensive. At the same time currency depreciation is a boon for exporters and NRI remittances.

- Historically, rupee was pegged at around Rs. 3.30 against dollar in 1947. It was at a fixed exchange system whereby Indian currency was pegged against pound and devalued as required. This started creating balance of payment problems from time to time. From 1985 India again started having economic problem which resulted into economic crisis in 1991. Finally in 1992, liberalized exchange rate system was introduced.

- The rupee remained in 40’s upto 2010 due to sustained foreign investments in country. It however continued its slide from 2010 to present level of over 75.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket #primarymarket #secondarymarket