Trends in Secondary Markets:

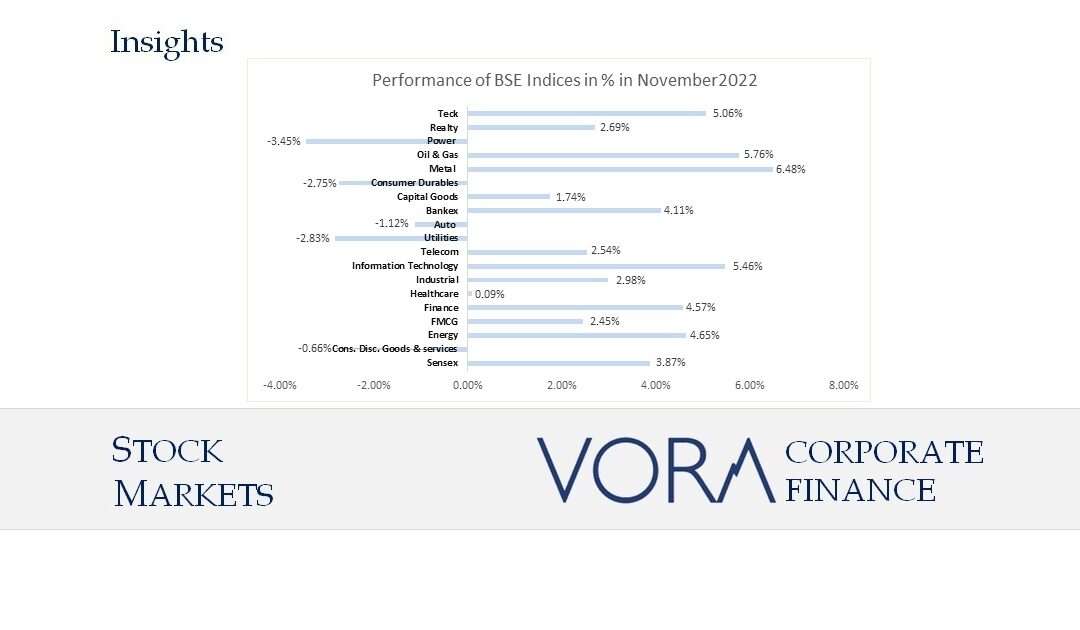

- The BSE Sensex was up by 2,353.06 points or 3.87% at 63,099.65 and NIFTY was up by 746.15 points or 4.20% at 18,758.35.

- FPI infused funds worth Rs 32,344 Crores in November. The rally was also driven by domestic players.

- Earnings growth in Q2 FY 23 was led by BFSI (banking, financial services & insurance), automobiles and telecom. Banks are doing well because of surging credit, rising interest rates and significantly reduced NPAs.

Primary Market:

There were as 9 main board IPOs in November against 2 in October as markets stayed bullish. Main board IPOs includeInox Green Energy Services Ltd., Kaynes Technology India Ltd., Archean Chemical Industries Ltd., Five-Star Business Finance Ltd., Bikaji Foods International Ltd., Global Health Ltd., Fusion Micro Finance Ltd., and DCX Systems Ltd.

There were 2 SME IPOs in November as against twelve SME IPOs in October 2022.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket