Economic Update:

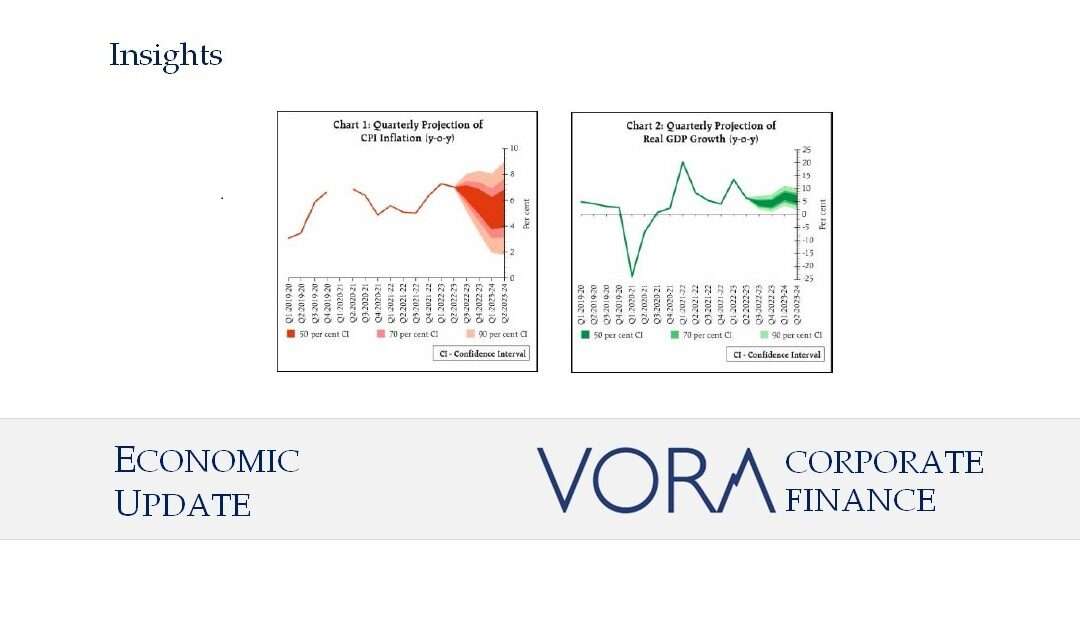

- The Reserve Bank of India (RBI) in its monetary policy meeting held on December 7, 2022 has yet again hiked the repo rate by 0.35%. This is the fifth consecutive repo rate hike since May of this year. The repo rate will go up from 5.9% to 6.25%.

- RBI will remain focused on withdrawal of accommodation to bring inflation down. CPI inflation in India has softened to 6.8% in October from 7.4 per cent in September with food inflation softening due to price of vegetables and edible oils.

- Indian economic activity is showing resilience and GDP in Q2FY23 was 6.3% y-o-y. However Global economy may lose momentum as countries tighten financial conditions to fight rising cost of livelihood because of food and energy price shocks and shortages.

- After about 2 years, India’ exports turned negative -16.6% in October, mainly due to global demand slowdown. Imports rose 6% because of crude oil, cotton, fertilizer & machinery.

COP27:

As covered in last update, Conference of the Parties (COP 27) of the UNFCCC (United Nations Climate Change Conference) was held and concluded in Sharm el-Sheikh, Egypt with following key developments.

Climate Finance was, as expected, a key part of COP27. The final agreement highlights that US$4 to $6 trillion a year needs to be invested in renewable energy until 2030 – including investments in technology and infrastructure – to reach net-zero emissions by 2050. However the Annex II (rich) countries legally obliged to give $100 Bn per year to climate fund have made far smaller contributions. This would hamper implementation in (poor) countries like Africa and other parts of global south like Pakistan.

- Private Finance: There is a surge of interest from companies and major investors,like investment banks, hedge funds, in adopting sustainable portfolios, and trillions of dollars are waiting to be unlocked, however right mechanisms are still awaited.

- A “loss and damage” fund was agreed for the first time for funding to vulnerable countries to rescue and rebuild the physical and social infrastructure of countries devastated by extreme weather. However there was no agreement on how the finance for this fund would be arranged.

- 1.5°C: The goal of COP26 to keep cutting greenhouse gas emissions to keep the temperature rise within 1.5 C was again agreed upon. Earlier in Paris agreement the goal was to keep the temperature rise within 2°C, however it is now clear that 2°C is not safe for earth.

- Low emission Energy: COP27 contained provisions to boost low emission energy, which could mean more focus on clean energy or relatively cleaner fuels like gas.

- Fossil Fuels: Many countries, led by India, wanted to include commitment to phase down all fossil fuels, however after intense debate it failed, and like Cop 26, only a commitment to phase down use of coal was agreed.

- India’s Net Zero Plan: India came out with the target to achieve net zero by 2070, as it promised in COP26. In the COP27 India deliberated upon the mechanism to achieve the target. India also promised to meet its 50% energy demand from renewable sources of energy.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket