Economic Snapshot: 2022

2022 was a challenging year for global economies as world order recovery from Covid-19 pandemic was subjected to geo-political tensions, record breaking inflation and steepest interest rate hikes in decades.

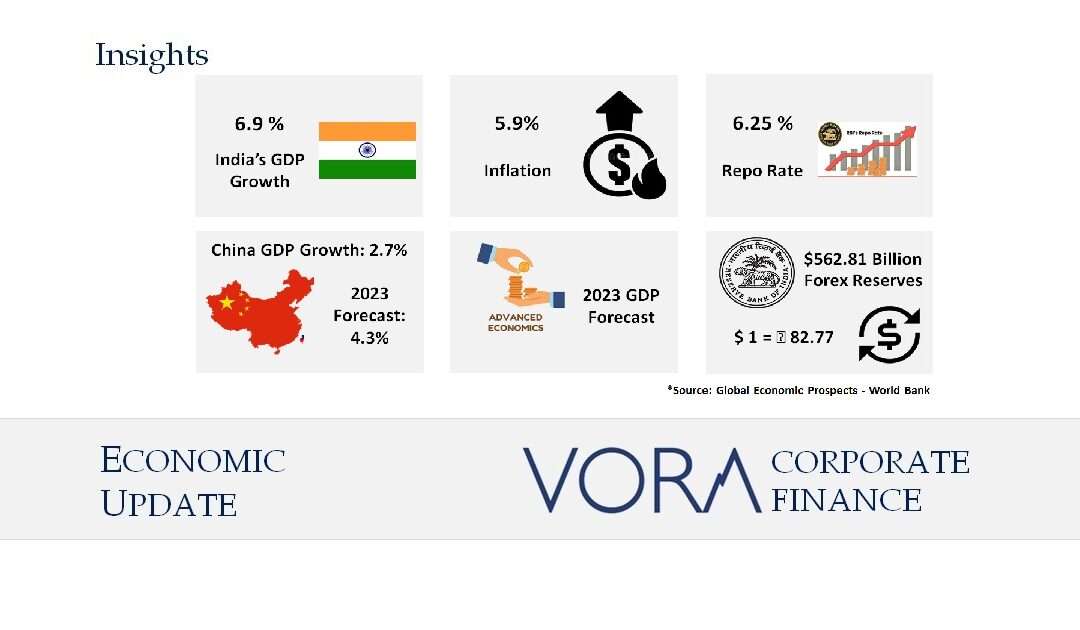

However as Global advanced economies are facing recession fears, India is has a fairly stable macroeconomic

environment. This along with factors like China +1 means that India would be in an advantageous position in coming years.

Advantage India:

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket