Summary:

With a third of world under lockdown, the Coronavirus pandemic has now started to affect economy. We examine its impact on capital market activities like IPO, PE, M&A and global and Indian stock markets. IMF along with other think tanks expect that world may see recessionary trends in 2020, we go thru their assessment and steps taken by governments to stabilize economies.

Introduction:

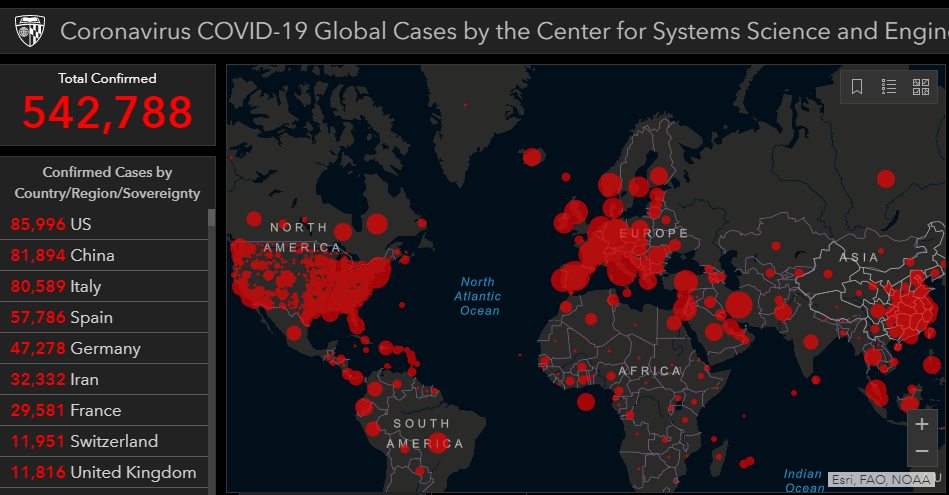

Coronavirus was recognized as a pandemic by World Health Organization on 11th March 2020. As on 27th March there are around 532,000 reported with around 24,000 deaths. The rapid spread of virus has caught most of the countries off guard and countries are forced to lock down population to contain the spread. India has declared a lock down for 21 days, and already over a third of world’s population is under lockdown.

Quarantine and factory shutdowns measures are having impact on economy as businesses are coping with loss of income and disrupted supply chains. The scale and speed of impact of covid-19 on global economic activity is astonishing and has been rarely seen outside natural disasters, financial crisis or military engagements. RBI governor Das predicted a big recession coming for all the world, and said India won’t be immune.

Government Actions:

The US Senate approved a US $2 Trillion stimulus package to address the economic impact of covid-19. This package is significant considering that the total spending of US government is around $4.5 Trillion for 2019. This package has around $500 Billion in assistance in form of loans to large businesses and local government and around $400 Billion to assistance to small businesses. The US Federal Reserve has also cut interest rate to almost zero to improve investor sentiment. EU has also launched a €750 billion stimulus programme for improving sentiments.

In India, FM Nirmala Sitharaman on 26th March announced Rs 1.7 lakh crore relief package aimed at around 800 million poorest people of India who will get direct cash transfers, cereals and cooking gas assistance. Government also announced insurance cover of up to Rs. 50 lakhs about 2 million frontline medical personnel.

Reserve Bank of India on 27th March announced further measures in line with FM. It announced that all commercial, regional, rural, NBFCs and small finance banks are being permitted to allow 3-month moratorium on payment of instalments in respect of all term loan EMIs. RBI will also inject liquidity in financial markets by open market operations and changing bank reserve requirement. RBI will auction targeted long term repo operations, reduce in CRR for all banks and increase marginal standing facility for bank from 2% to 3% to increase liquidity of around Rs. 374 thousand Crore in the market.

RBI also reduced repo rate by 75 basis points to 4.4% and maintained the accommodative stance. (You can go thru https://vorafin.com/insights/capital-markets-update-november-2019/ to understand more about repo rates and RBI monetary policy measures)

We believe that the recent actions by government of India are timely in stopping the downward slide of economy. However covid-19 is likely to have a severe impact on economy and it will take many more measures to restore the economy back on growth.

Impact on Primary Market:

Primary markets are worst hit in the Covid-19 crisis. As the stock markets are in free fall, the valuations of companies have eroded significantly. With already slowdown in economy only one IPO of SBI cards was completed in 1st quarter of 2020 on main board. Now with impact of covid-19 most of the companies like Burger King India Ltd. are postponing their Planned IPOs.

Private Equity and Mergers & Acquisitions deals will be slow as well. With present valuation it doesn’t make sense for companies to go for additional private equity unless they have financial stress. With recessionary trends on horizon the Private Equity funds will also try to support their existing portfolio companies and will shy away from making new bets. M&A deals have also slowed down considerably and only few deals which were almost complete got announced recently.

Impact on secondary markets:

Nearly a third of the global market cap has been shaved off due to Coronavirus pandemic within few weeks. Stock exchanges like FTSE (UK), Dow Jones Industrial Average (USA) and the Nikkei (Japan) have seen huge falls since the outbreak of coronavirus.

The impact on global Indices BEFORE the recovery due to government stimulus package is as above.

Dow Jones and FTSE saw their biggest one day declines since 1987. Dow Jones was at peak of around 29,500 in mid-February from which it has corrected to around 22,500 after touching low of 18,590, i.e. a correction of around 25% in last month. It has bounced back marginally in last week on back of government stimulus of $2 Trillion.

In India, Sensex and Nifty saw highest losses ever after rising number of coronavirus cases in India and the resultant lockdown in a majority of states took a heavy toll on the financial markets. Sensex is witnessing extreme volatility and is at around 29,500 at the time of writing this from low of around 25,600 and from peak of around 42,200 a month back, i.e. drop of 30% in one month from peak. Nifty has also fallen around 30% to 8,678 from peak of 12,430 in last month.

While overall market is down by around 30% in Impact on indices from 1st February to 26th March is also largely negative. Healthcare companies were least impacted because of expectation of need for more medical equipments to fight covid-19. Telecom was also stable due to government reliefs to telecom companies. On the other hand most other indices saw free fall. Especially Realty, metal, Industrial goods and capital goods were on the receiving end as economic slowdown will impact them the most. Bankex and Finance stocks also registered significant losses as companies will struggle financially.

Impact on Oil:

Oil market was already in turmoil due to unexpected price war between Saudi Arabia and Russia which had flooded the market with oil supply. Now with Covid 19 pandemic, the demand outlook looks very grim. India, world’s third largest oil consumer is already under lock down. That with other major cities of world under lock down the demand of oil is destroyed. The Brent crude which was between $60 to $70, in year 2019 is trading at around $26 to $28 in last week of March 2020.

Impact on Gold:

Generally when markets go down, the gold prices increase as the investors expect the gold a less risky investment and prefer it in times of uncertainty. However in recent crisis, even the gold prices are declining. The gold prices are declining as the investors are rushing for cash and are fearful of a recession. Though decline in gold price is arrested in last 5 days after various stimulus offered by governments.

What lies ahead:

Most of the thinktanks expect that the Coronavirus crisis will have a severe impact on global economy and the world will see recessionary trends in 2020.

MD of International Monetary Fund Kristalina Georgieva said in a statement that “First, the outlook for global growth: for 2020 it is negative—a recession at least as bad as during the global financial crisis or worse. But we expect recovery in 2021. The economic impact is and will be severe, but the faster the virus stops, the quicker and stronger the recovery will be.” She further added that the emerging economies will face significant challenges. Investors have already removed US$83 billion from emerging markets since the beginning of the crisis, the largest capital outflow ever recorded.

Moody’s expects the GDP growth to by Negative (0.5%) for 2020, meaning a global recession. It has also slashed the economic growth forecast for India to 2.5% for 2020, even though it expects GDP to bounce back to 5.8% in 2021. Moody’s said that “The severe compression in demand over the next two to four months will likely be unprecedented, as China’s data for the months of January and February reveal. Also, as expected, purchasing managers’ index indicators for the euro area confirm a sharp contraction is already underway. Moreover, the widespread loss of income for businesses and individuals across countries will have a multiplier effect throughout the global economy,”

Fitch Rating has halved the global GDP forecast for 2020 to 1.3% from 2.5% in December 2019 and expects global recession if more lockdown are enforced. Fitch expected the shock in Chinese economy to be severe and the GDP to fall to 1% from 5%. While travel, tourism and leisure have been disrupted, it expects that the impact on supply chain will continue to be felt profoundly for some time.

The Organization for Economic Co-operation and Development (OECD) decreased expected global growth to 2.4% from 2.9%, and warned that it could fall to 1.5%. Goldman Sachs expects a global contraction in the first half of the year. According to a report, economic fallout could include recessions in the U.S., Europe and Japan, the slowest growth in China, and a total of $2.7 trillion in lost output globally.

Sectors such as tourism and travel will be among the hardest hit as authorities encourage “social distancing” and people prefer to stay indoors. The International Air Transport Association warns that COVID-19 could cost global air carriers between $63 billion and $113 billion in revenue in 2020. Industries that do not require high social interaction, such as agriculture, will be comparatively less vulnerable but will face challenges like demand wavers.

According to the latest CNBC Global CFO Council survey, 40% of the companies already having or expecting supply chain issues said that it could take between three and six months to get business back to normal once the issues end (25% said six months).

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after fund raising, debt, valuations, private equity and mergers and acquisitions. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.