Secondary Market:

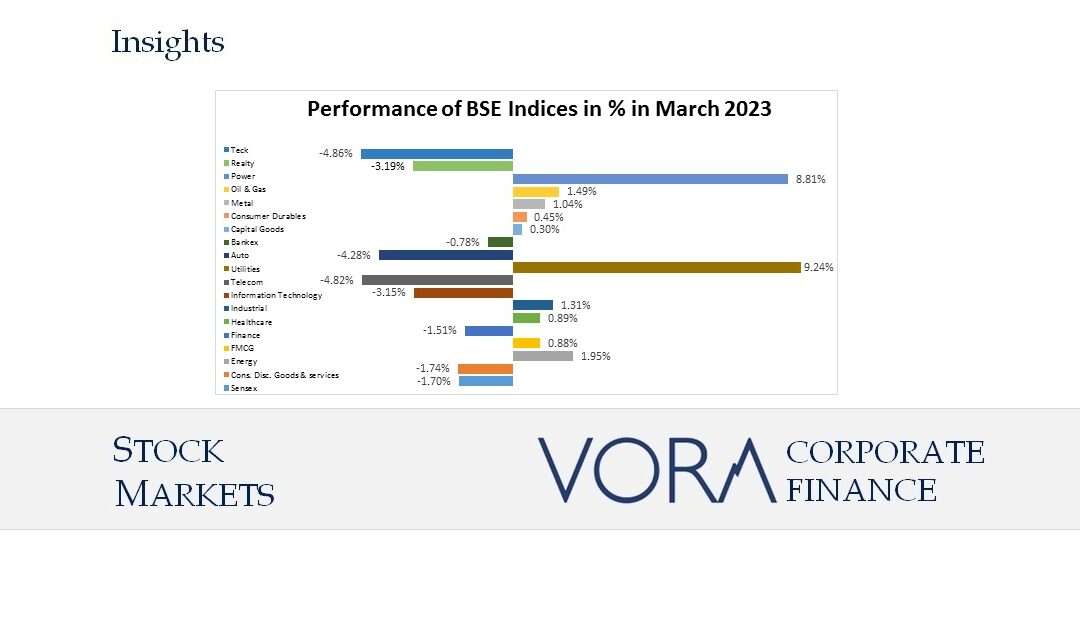

- The momentum in the equity markets fell during mid-March, 2023 with Nifty and Sensex falling by respectively 1.29% and 1.70% respectively over the previous month.

- Market was affected by global banking crisis and persisting inflation. Major events included the collapse of the Silicon Valley Bank (SVB), Credit Suisse’s buyout by rival UBS, global inflation, and continuing geopolitical tensions.

- In January and February 2023, FPIs sold Indian equities worth $4.21 billion due to expectations of further hawkishness from the Fed and fears of an impending global slowdown. March was better with FPIs ending up as net buyers to the tune of $966 million. However, this was largely accounted for by the $1.9 billion purchase of Adani group shares by GQG Investments. In March FIIs bought equities worth Rs 1,997.70 Crore and DIIs Rs 30,548.77 Crore.

Primary Market Update:

There were 2 main board IPOs in March, 2023 of Divgi Torqtransfer Systems Limited, and Global Surfaces Limited against 0 main board IPOs in February, 2023, IPOs have dried down as markets has turned bearish. However there were 11 SME IPOs in March, 2023 as against 3 SME IPOs in February, 2023.

Divgi Torqtransfer Systems Limited

- Established in 1964, Divgi Torqtransfer Systems Limited is suppliers of transfer case systems to automotive OEMs and transfer case system to passenger vehicle manufacturers in India.

- IPO comprised of fresh issue aggregating up to 180 Crore and an Offer for Sale of up to 39 Lakh shares.

- The net proceeds from the issue will be used for Funding capital expenditure requirements for the purchase of equipment/machineries of the manufacturing facilities and General corporate purposes

- The Rs 412 Crore IPO was subscribed 5.44 times by the final day of the public offer.

- The IPO was led by mainly retail investors and listed at premium of 5% on NSE.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket