Trends in Secondary Markets:

BSE Sensex went up by 4.13% to close at 58,569 in March 2022 as against 3.05% lower to close at 56,247 in February 2022. Nifty 50 closed at 17,465 that is 3.99% higher as against 3.15% lower to close at 16,794 in February 2022.

Foreign Institutional Investors (FIIs) invested Rs.1910 Crore while Domestic Institutional Investors (DIIs) divested Rs.184 Crore from the Indian equity markets in the month of March 2022.

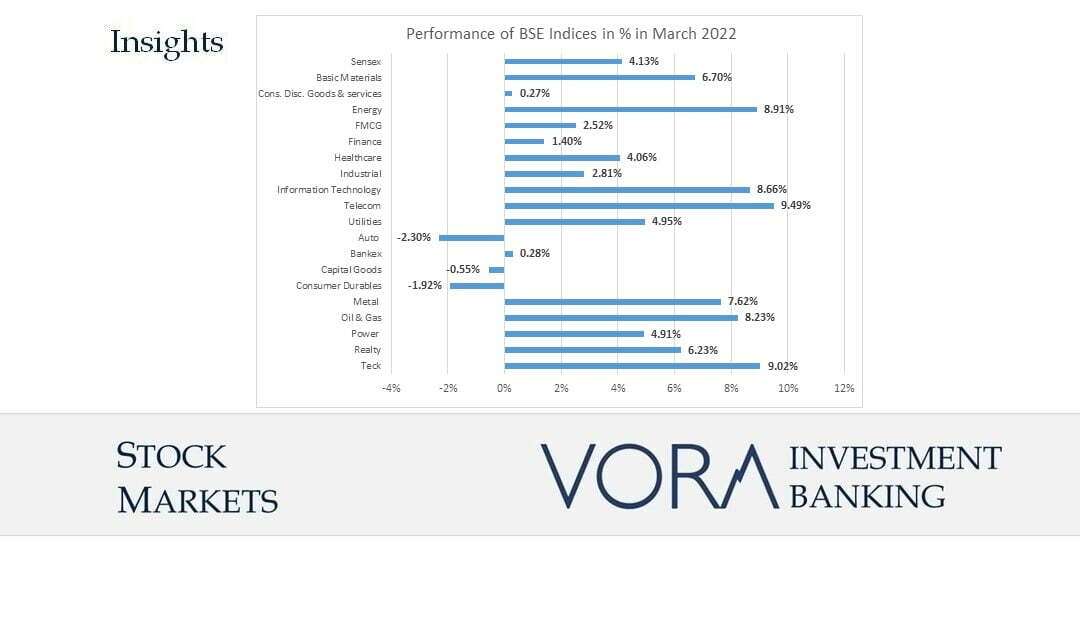

Majority of the BSE Indices were positive in the month of March. The highest increase was in Telecom (9.49%), Teck (9.02%), Energy (8.91%) and others. Metal stocks have performed very well due to Russia Ukraine crisis which has resulted into increase in commodity prices. Metal index has gained in the last few sessions. Other sectors that stand to benefit from supply chain shocks due to Russia-Ukraine crisis are the Indian IT industry, tech, financials, and capital goods. The real estate sector also had reasons to cheer as the home sales in the first quarter of 2022 are highest in last seven years due to lower interest rates and preference for home ownership.

Primary market Update:

There was no mainboard IPO in March 2022 as against two mainboard IPOs of Vedant Fashions Limited and Adani Wilmar Limited in February 2022. There were four SME IPOs of Ekennis Software Service Limited, Bhatia Colour Chem Limited, Achyut Healthcare Limited and Evoq Remedies Limited in March 2022 as against four SME IPOs in February 2022.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket #primarymarket #secondarymarket