M&A: UBS to acquire Credit Suisse for $3.2 Billion

Transaction:

- UBS to buy Credit Suisse (CS) for 3 billion Swiss francs ($3.2 billion) as part of a government-backed, cut-price deal.

- Swiss authorities and regulators helped to negotiate the agreement, which came amid fears of contagion to the global banking system after two smaller U.S. banks collapsed in recent weeks.

- The state has also explicitly guaranteed a 100 billion Swiss franc ($109 billion) lifeline to UBS, should it need it, although that would be repayable.

About Credit Suisse:

- Founded in 1856, Credit Suisse is the second largest lender of Switzerland and one of the biggest financial institution in the world.

- Credit Suisse serves the clients through four divisions: Wealth Management, Investment Bank, Swiss Bank and Asset Management structure in four strong regions: Switzerland, EMEA, APAC and Americas.

About UBS:

- Founded in 1862, UBS Group AG is a multinational investment bankand financial services company based in Switzerland. It is one of the eight global “Bulge Bracket” banks.

- UBS has over CHF 3.2 trillion in assets under management (AUM), approximately CHF 2.8 trillion of which are invested assets.

Rationale:

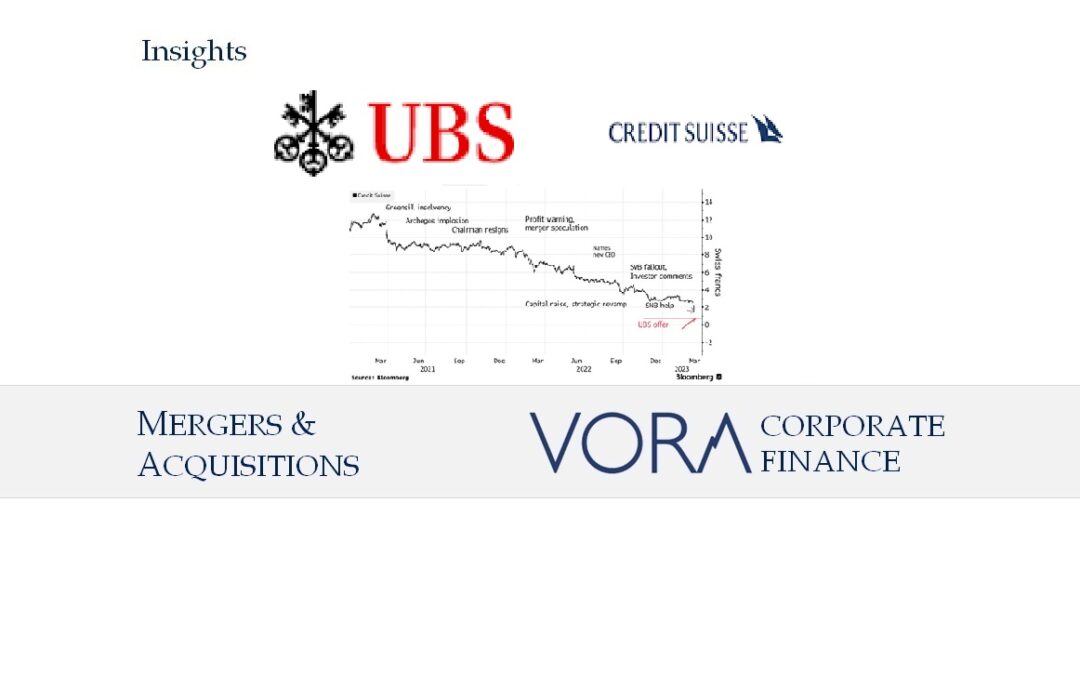

- In last decade, Credit Suisse was plagued by a series of compliance failures and ended up making billions in losses due to misplace bets and paying billions of dollars in penalties.

- CS reported a loss of over 7 Billion Francs in 2022. Market capital of bank took a severe beating.

- Credit Suisse also saw erosion of consumer confidence and saw net asset outflow of over $100 Bn Swiss Francs in 2022, which prompted the bank to take an emergency lifeline of $50 Bn Swiss Francs borrowing from Swiss National Bank.

- Credit Suisse was also impacted as the Central Banks across the globe are rising interest rates to combat inflation. While failure of US Silicon Valley Bank raised fresh concerns on banking sector.

- Finally, the emergency rescue deal was brokered by Swiss Government to merge Switzerland’s two biggest and best-known banks. The negotiations started on 15th March and were concluded in just 5 days to prevent panic in markets.

- The Swiss National Bank said that the rescue would “secure financial stability and protect the Swiss economy.”

- UBS will buy Credit Suisse for 3 Billion Swiss Francs, i.e. at a steep discount of 60% to its last closing market price. Also the owners of tier one bonds called AT1 of CS of around 17 Bn franks will see the value of their holdings slashed to zero.

- UBS has strong financials and its valuation has climbed more than 15% in last two years, with last year’s profit of over 7 Billion francs. The takeover will make UBS one of the largest wealth manager in the world. UBS expects significant cost synergies also in coming years and expects to downsize the Investment Banking business of Credit Suisse.

- Financial market regulators around the world cheered the takeover in the hopes that deal will stop the banking meltdown spreading across global financial systems.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket