Transaction:

- The Proposed Transaction between Innovative and Zoomcar is structured as a merger of an Innovative subsidiary a publicly traded Special Purpose Acquisition Company (SPAC) and Zoomcar.

- The Proposed Transaction values Zoomcar at an implied pro forma enterprise value of approximately $456 million.

- The merged entity will be listed on the NASDAQ Stock Exchange, with its name changed to Zoomcar Holdings Inc.

About Zoomcar:

- Founded in 2013 and headquartered in Bengaluru, India, Zoomcar is an online platform that allows users to book self-drivable cars for short or long trips on rental basis.

- Zoomcar is the leading marketplace for car sharing across India, Southeast Asia and the MENA region, with over 25,000 cars currently available to guests using its platform.

About Innovative International Acquisition Corp.:

- Innovative is a blank check company commonly referred as a Special Purpose Acquisition Company (SPAC) incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, , share purchase or similar business combination with one or more businesses.

- Innovative conducted a successful IPO in October of 2021, in which it raised $235 million with investment thesis to find an acquisition target in the sectors of consumer technology, healthcare, information technology services and enterprise software as a service.

Rationale:

- Zoomcar will the use proceeds from the transaction with Innovative to accelerate technology development and new market entry while also continuing to invest in growth across existing markets.

- Zoomcar is backed by number of PE funds and family offices including Sequoia Capital, Mahindra & Mahindra, Ford Motors amongst others and had raised $92 million equity in series E round by Stern Aegis Ventures last year (Nov 2021) to a total fund raise of over $300 million.

- This merger will make Zoomcar a publically traded company with common stock on NASDAQ at an enterprise value of $456 Million.

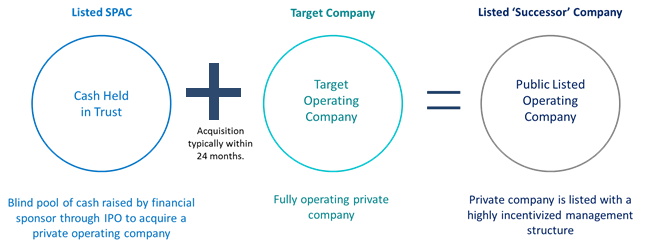

About SPAC:

- SPACs – Special Purpose Acquisition Companies—are publicly-traded investment vehicles that raise funds via an initial public offering (IPO) in order to complete a targeted acquisition.

Mechanism:

- SPACs are also known as “Blank Check Companies”, a shell corporation listed on stock exchange.

- SPACs raise funds largely from public investors for specific purpose of M&A and with set timeframe of 18 to 24 months.

- If SPAC does not merge within the timeline, then it will be liquidated and all the funds will be returned to the investors.

Performance:

- In 2019, SPAC IPOs raised $13.6 billion in 2019, more than four times the $3.5 billion they raised in 2016. Interest in SPACs increased in 2020 and 2021, with as much as $83.4 billion raised in 2020 and $162.5 billion in 2021. As of March 13, 2022, SPACs have raised $9.6 billion. In 2020, SPACs accounted for more than 50% of new publicly listed U.S. companies.

- Some of the better known companies to have become publicly listed by merging with a SPAC are digital sports company DraftKings; aerospace company Virgin Galactic; energy storage innovator QuantumScape; and real estate platform Opendoor Technologies.

Benefits of SPAC:

- SPACs allow acquired (target) companies to go public without going through the traditional IPO Process, often at better terms than traditional IPO would.

- SPAC founders have the ability to create additional SPACs.

- SPACs offer faster capital-raising relative to private fund-raising. The accelerated execution and liquidity timeline is typically within 24 months from IPO to M&A.

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket #primarymarket #secondarymarket