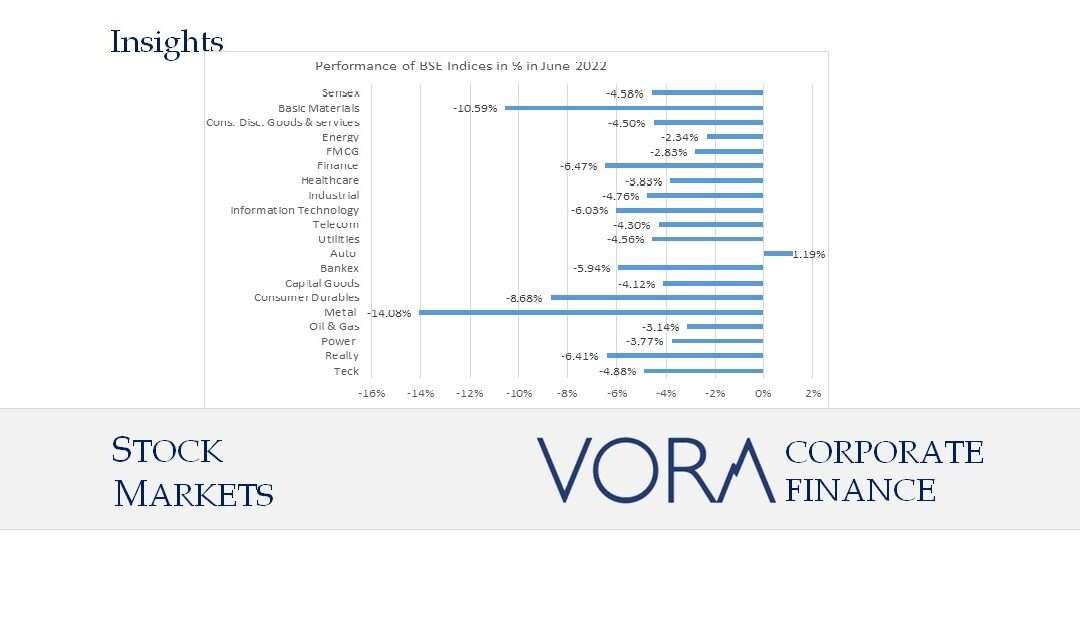

BSE Sensex remained bearish and closed at 53,018 points in June 2022 down by 4.58%. Nifty 50 closed at 15,780 that is 4.85% correction in the month of May.

- Indian equity markets weakened in the first half of June 2022 owing to growing fears of recession, which triggered sell-offs across the globe on investors’ risk aversion.

- Furthermore, weak global cues following the announcement of a 75 bps hike in the policy rate by the US Fed also dampened market spirits.

- The domestic equity market rebounded, however, in the second half of June and extended the gains in July amidst softening commodity prices and positive cues emanating from gains in global equity markets.

- Amidst monetary tightening, global investors are shunning emerging market assets. Foreign portfolio investors (FPIs) were net sellers in the Indian equity market for the ninth consecutive month in June.

- FPIs have withdrawn 1.2 lakh crore from the Indian equity market in 2022-23 so far, but the sell-off has been absorbed by domestic institutional investors (DIIs). DIIs have invested in equity markets for the 16th consecutive month in June 2022, with a net inflow of 1.3 lakh crore in 2022-23 so far, highlighting the positive sentiment among domestic investors.

- Foreign Institutional Investors (FIIs) divested Rs. 58,112 Crore (Net Sales) while Domestic Institutional Investors (DIIs) invested Rs. 46,599 Crore (Net purchases) from the Indian equity markets in the month of June 2022.

|

Equity Markets |

Jun-22 |

May-22 |

Change% |

|

Sensex |

53,019 |

55,566 |

-4.58% |

|

Nifty 50 |

15,780 |

16,585 |

-4.85% |

|

BSE 500 |

21,324 |

22,498 |

-5.22% |

|

BSE Bankex |

38,476 |

40,907 |

-5.94% |

|

BSE Consumer Durables |

34,699 |

37,999 |

-8.68% |

|

BSE Healthcare |

21,606 |

22,467 |

-3.83% |

|

BSE FMCG |

13,766 |

14,167 |

-2.83% |

Primary market Update:

There were two main board IPOs in May, of eMudhra Limited and Aether Industries Limited as against eight IPOs in May 2022. There were three SME IPOs in June as against four SME IPOs in May 2022.

IPO of Speciality chemicals company Aether Industries was subscribed more than 6 times and listed at strong premium of over 20% to its issue price. IPO of eMudhra limited listed at around 5% premium to issue price but gave up the gains at the end of listing day to end at close to issue price.

|

Particulars |

Mar-22 |

Apr-22 |

|

I. Equity Issue |

4,461 |

19,588 |

|

a. IPOs (i+ii) |

175 |

519 |

|

i. Main Board |

0 |

390 |

|

ii. SME Platform |

175 |

129 |

|

b. FPOs |

0 |

4,300 |

|

c. Equity Rights Issue |

878.9 |

138 |

|

d. QIP/IPP |

2,079 |

959 |

|

e. Preferential Allotment |

1,329 |

13,675 |

|

II. Debt Issue |

39,903 |

14,750 |

|

a. Debt Public Issue |

178 |

384 |

|

b. Private Placement of Debt |

39,725 |

14,366 |

|

Total Funds Mobilised (I+II) |

44,364 |

34,338 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket #primarymarket #secondarymarket