Trends in Secondary Markets:

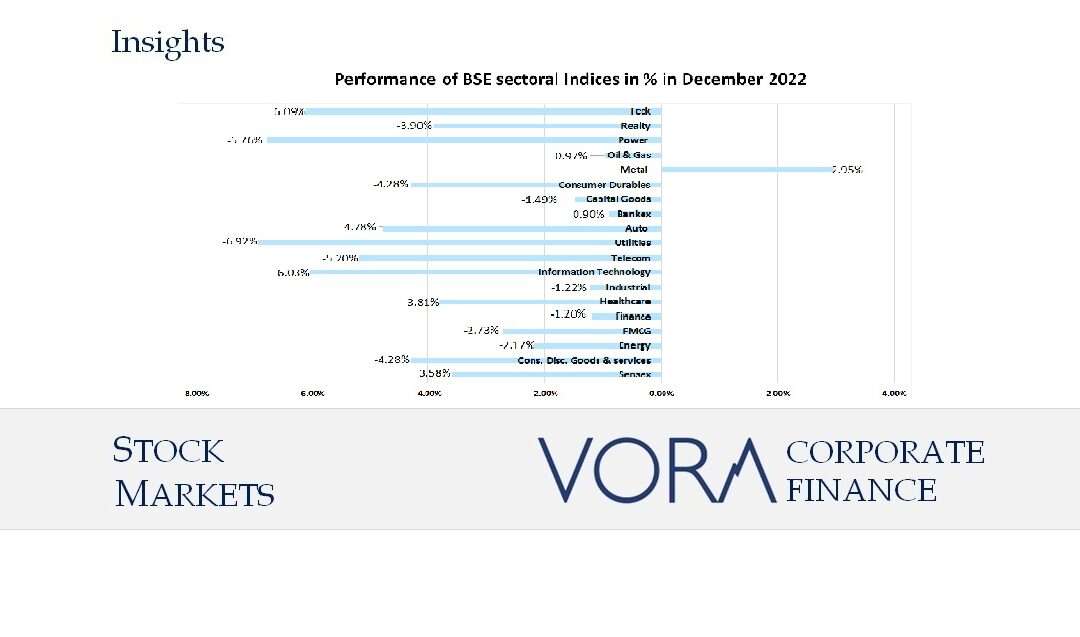

- The strong momentum in equity markets discontinued during December 2022, with Nifty and Sensex falling by respectively 18,105.30 and 60,840.74 mark. During December 2022, Nifty and Sensex fell by -3.48 per cent and -3.58 per cent respectively over previous month.

- The S&P BSE Bankex has surged 18% this year on the sector’s successful resolution of sour debts, the creation of a bad bank to offload troubled loans and a sharp recovery in credit demand. While the big winners during the Covid era, pharma and IT, did not fare well in 2022.

FPI Movements:

- While 2020-21 was a year of record inflows by foreign portfolio investors (FPIs) due to ultra-low global interest rates, 2022 was a year of massive outflows.

- FPIs have withdrawn over Rs 1.34 lakh Crore. The first half of the year saw FPIs selling equities and bonds worth more than Rs 2 lakh Crore. Aggressive monetary policy tightening by global central banks, rupee depreciation, rise in global crude oil prices and fears of global recession triggered outflows of capital.

- The second half saw a return of foreign investments. In the second half, there were growing indications that the pace of rate hike will go slow amid moderation in US inflation. After peaking in June, US inflation has seen a gradual moderation. This optimism fuelled the return of FPIs to Indian markets.

- In addition, robust earnings of the corporate sector and healthy balance-sheets of banks led FPIs returning to the Indian markets.

Primary Market Update:

- There were as 7 main board IPOs in December against 9 main board IPOs in November as markets still stayed bullish. Main board IPOs include Elin Electronics Limited, KFin Technologies Limited, Landmark Cars Limited, Abans Holdings Limited, Sula Vineyards Limited, Uniparts India Limited, and Dharmaj Crop Guard Limited. There were 3 SME IPOs in December as against 2 SME IPOs in November 2022.

- Elin is a one-stop solution provider, offers Electronic Manufacturing Services, Rs 475 Crore IPO was booked 3.09 times. The issue comprises a fresh issue of equity shares totaling Rs 175 and an offer-for-sale (OFS) of Rs 300 Crore. 50% of the IPO was reserved for QIBs, while NIIs could bid for 15% and retail investors for the remaining 35%. The IPO price band was fixed at Rs 234-247 per equity share.

IPOs in 2022:

- In 2022, the IPOs (Initial Public Offers) halved to 38 from 64 in 2021, but overall they delivered strong returns of about 32% to the subscribers. Major reason behind this mixed performance by the IPO market in 2022 was geopolitical tension caused by Russia-Ukraine crisis in the beginning of the year 2022 followed by global economic crisis. Over the past six months, the global energy and food supply shocks have intensified. This is the list of top 10 IPOs based on the funds raised.

- Performance of these IPOs varied largely. Hariom Pipe Industries Limited was the highest gainer on the day of listing followed by Aether Industries Limited. Kaynes Technology India Limited was the third highest gainer on the day of listing. Rainbow Children’s Medicare Limited didn’t do well on the day of listing followed by Prudent Corporate Advisory Services Limited.

- Currently, Adani Wilmar Limited is trading above around 147% of the issue price followed by Hariom Pipe Industries Limited which is trading at around 125% above the issue price. Whereas, Life Insurance Corporation of India is trading 28% below the issue price in spite being the largest IPO of Indian History over taking the IPO of Paytm.

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.

#mergersandacquisitions #privateequity #ipo #debt #debtsyndication #valuations #rating #creditrating #financeadvisory #finance #economy #indianeconomy #fundraising #capitalmarket #capital #banking #m&a #ma #pe #initialpublicoffer #businessloan #loan #businessvaluation #registeredvaluer #acquisition #merger #deals #financialdeals #ahmedabad #gujarat #india #ratingadvisory#primarymarket #secondarymarket #mergersandacquisitionsahmedabad #maahmedabad #privateequityahmedabad #ipoahmedabad #financeadvisoryahmedabad #stockmarket