Secondary Market Update:

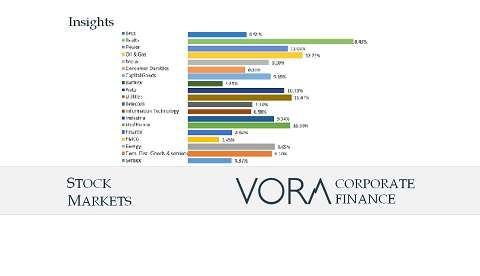

- The Indian stock markets continued their rally with Nifty 50 and Sensex gaining 5.52% at 20,133.15 and 4.87% at 66,988.44 respectively.

- The surge comes on the back of positive market sentiment driven by better-than-expected GDP growth in the September quarter, FPIs returning as buyers in November, a decline in US treasury yields and a fall in oil prices. Moreover, upgrades by various brokerages on FY24 India GDP growth has also aided the gains.

- This performance is noteworthy because it approaches the highest gains recorded following the February 2021 series, when the small-cap increased by 12.8% and the midcap soared by 12.7%.

- The auto sector gained due to increased sales numbers witnessed because of festival cheer, while the premium valuation restricted the upside potential.

- FPIs bought Indian equities worth Rs. 9,001 Crore after selling shares worth Rs. 24,548 Crore in October and Rs. 14,767 Crore in September, data with the depositories showed.

- The rally was also fueled by the dovish stance of US Feds which is leading to decline in US yields and should likely result into capital inflows into Indian economy.

Primary Market Update:

There were 10 main board IPO in November, 2023 of Flair Writing Industries Limited, Fedbank Financial Services Limited, Tata Technologies Limited, Gandhar Oil Refinery (India) Limited, Indian Renewable Energy Development Agency Limited, ASK Automotive Limited, Protean eGov Technologies Limited, ESAF Small Finance Bank Limited, Honasa Consumer Limited, Cello World Limited, and Blue Jet Healthcare Limited against 06 IPOs in October, 2023. There were 05 SME IPOs in November, 2023 as against 04 SME IPOs in October, 2023.

IPO market is extremely bullish as retail investors are over subscribing most IPOs due to positive sentiments and perceived reasonableness of valuations of IPOs compared to existing higher valuation multiples of listed peers.

Tata Technologies Limited:

|

Tata Technologies Limited |

Founded in 1994, Tata Technologies is a global engineering services company offering product development and digital solutions, including turnkey solutions, to OEMs and their Tier-I suppliers. The company is primarily focused on the automotive industry. |

|

Funds Utilization |

The IPO will help to achieve the benefits of listing the Equity Shares on the Stock Exchanges; and Carry out the Offer for Sale of up to 95,708,984 Equity Shares by the Selling Shareholders. |

|

IPO Performance |

Tata Technologies IPO was entirely an offer for sale (OFS) of 6.09 Crore equity shares by the promoter and investors. Promoter Tata Motors will offload 4.62 Crore equity shares worth Rs. 2,313.75 Crore in the OFS, while investors Alpha TC Holdings Pte. Ltd will sell 97.17 lakh shares and Tata Capital Growth Fund I will offload 48.58 lakh shares in the Tata Technologies IPO. The company raised Rs 791 Crore from anchor investors ahead of its IPO. The IPO listed at a premium of 140% and then rose nearly three-fold the IPO price. Tata Group’s first initial public offering (IPO) in almost 20 years was subscribed over 69 times by the final day of bidding. It jumped 180% over the IPO price to Rs 1,400 within minutes. |

Funds Mobilization by Corporates (Rs. In Crore)

|

Particulars |

Sept- 23 |

Oct-23 |

|

I. Equity Issues |

14,657 |

15,829 |

|

a. IPOs (i+ii) |

9,284 |

5,158 |

|

i. Main Board |

8,758 |

4,478 |

|

ii. SME Platform |

526 |

680 |

|

b. FPOs |

0 |

0 |

|

c. Equity Rights Issues |

280 |

130 |

|

d. QIPs/IPPs |

3,102 |

5,609 |

|

e. Preferential Allotments |

1,991 |

4,932 |

|

II. Debt Issues |

52,394 |

36,231 |

|

a. Debt Public Issues |

2,318 |

2,972 |

|

b. Private Placement of Debt |

50,076 |

33,259 |

|

Total Funds Mobilized (I+II) |

67,051 |

52,060 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.