Secondary Market:

- The BSE Sensex closed at71,752.11 by -0.68% and the Nifty 50 closed at 21,725.70 by -0.03% in the month of January 2024.

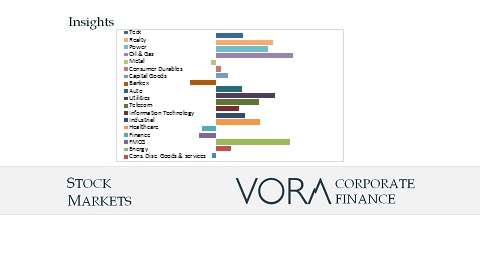

- There’s a noticeable rally in cyclical stocks, driven by the broader economic outlook and expectations of growth.

- The increased buying activity, possibly spurred by positive market sentiment and the anticipation of strong future earnings, is maintaining an upward momentum in stock prices.

- While some sectors like IT, FMCG, and Pharma are underperforming, their impact is overshadowed by the gains in other sectors.

- Investor sentiment seems to be tilting towards optimism, driven by expectations from the interim budget and the consequent potential growth in key sectors.

Primary Market Update:

There were 04 main board IPOs in January 2024 of Nova Agritech Limited, Epack Durable Limited, Medi Assist Healthcare Services Limited, and Jyoti CNC Automation Limited against 12 main board IPO in December 2023. There were 07 SME IPOs in January 2024 as against 07 SME IPOs in December 2023.

Jyoti CNC Automation Limited:

|

About the Company |

Incorporated in January 1991, Jyoti CNC Automation Ltd. is a manufacturer & supplier of CNC machines. The company has three manufacturing facilities, two of which are located in Rajkot, and third in Strasbourg, France. For H1 FY24, the company reported a net profit of Rs. 3.35 crore on a total income of Rs. 510 Crore. |

|

Funds Utilization |

The company planned to use the net proceeds from the fresh offering for long-term working capital needs; to pay back some of the borrowings, and for general corporate purposes. |

|

IPO Performance |

The IPO was worth Rs. 1,000 crore and was completely a fresh issue; there was no offer for sale (OFS) component. The IPO made a lukewarm debut on the bourses. On NSE, Jyoti CNC shares were listed at Rs. 370 per share, 11.78% higher than the issue price of Rs. 331. On BSE, Jyoti CNC share price was listed at Rs. 372 apiece, up 12.39% than the issue price. |

Funds Mobilization by Corporates (Rs. In Crore)

|

Particulars |

Nov-23 |

Dec-23 |

|

I. Equity Issues |

27,684 |

41,372 |

|

a. IPOs (i+ii) |

13,431 |

9,534 |

|

i. Main Board |

13,016 |

8,932 |

|

ii. SME Platform |

415 |

602 |

|

b. FPOs |

0 |

0 |

|

c. Equity Rights Issues |

112 |

38 |

|

d. QIPs/IPPs |

11,364 |

15,613 |

|

e. Preferential Allotments |

2,778 |

16,187 |

|

II. Debt Issues |

71,357 |

1,10,090 |

|

a. Debt Public Issues |

264 |

2,014 |

|

b. Private Placement of Debt |

71,357 |

1,08,076 |

|

Total Funds Mobilized (I+II) |

99,305 |

1,51,462 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction