Secondary Market:

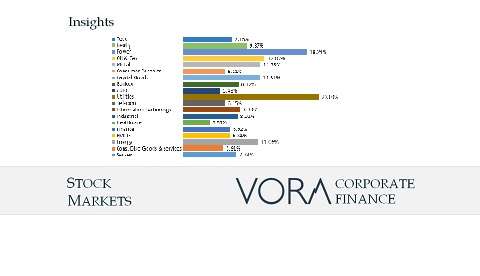

- The Indian stock markets continued their rally with substantial gains at Nifty 50 and Sensex gaining 7.94% at 21,731.40 and 7.84% at 72,240.26 respectively.

- The Nifty Index finished the year with a gain of 20.03%, experiencing a remarkable surge of more than 65% in the final months of November and December. Notably, in December alone, the index recorded a substantial gain of 7.94%, marking its best December performance in the last two decades.

- The Indian stock market has been up by around 25 percent this year, crossing the overall market valuation of $4.16 trillion.

- India is the fifth largest economy in the world, and its stock market valuation is currently only behind US, China, Japan and Hong Kong, joining the ranks of superpower in the financial world.

- The market rally was propelled by significant retail participation and sustained foreign portfolio investor (FPI) inflows, bolstered by improved global sentiment and strong domestic economic growth.

- The decision by the US Federal Reserve to pause its rate hike trajectory and signal potential rate cuts in 2024 has significantly boosted investors’ confidence. This led to a shift in investor preference from bonds to equities. Further, the drop in key commodities such as crude oil prices further contributed to the market’s buoyancy.

Primary Market Update:

There were 12 main board IPO in December, 2023 of Innova Captab Limited, Azad Engineering Limited, Happy Forgings Limited, Credo Brands Marketing Limited, RBZ Jewellers Limited, Suraj Estate Developers Limited, Motisons Jewellers Limited, Muthoot Microfin Limited, Inox India Limited, DOMS Industries Limited, India Shelter Finance Corporation Limited and Flair Writing Industries Limited against 10 IPOs in November, 2023. There were 07 SME IPOs in December, 2023 as against 05 SME IPOs in November, 2023.

India’s IPO market is poised for continued growth, driven by a combination of factors, including a resilient economy, investor confidence, a supportive regulatory environment, and the rise of tech-focused companies. As India’s financial markets mature and its economy expands, the IPO market will play an increasingly crucial role in fueling the nation’s growth and creating wealth for investors.

DOMS Industries Limited:

|

About the Company |

Incorporated in 2005, DOMS Industries stands as a prominent entity in the stationery and art product sector. The company has cultivated a global footprint, spanning across more than 40 countries. According to the Technopak Report, DOMS Industries is the second-biggest player in the Indian market for branded “stationery and art” products, holding a market share of about 12% by value as of fiscal 2023. The net profit increased by more than 5 Times to Rs 95.8 Crore for FY23 with revenue increasing to Rs 1,212 Crore during the same period. |

|

Funds Utilization |

The net proceeds from the new issue will be used, in part, to pay for general corporate purposes and the cost of building a new manufacturing facility to increase production capacity for a variety of writing instruments, watercolor pens, markers and highlighters. |

|

IPO Performance |

DOMS Industries IPO comprises a fresh issue of shares of up to Rs. 350 Crore and an offer for sale (OFS) of equity shares with face value of Rs. 10 each by a promoter and others aggregating up to Rs. 850 Crore. DOMS Industries IPO issue size is Rs. 1,200 Crore. The IPO was overall subscribed 93.52 times, heavy bidding from qualified institutional bidders (QIBs), whose quota was booked 115.97 times. DOMS stock was listed at Rs 1400 as against an offer price of Rs 790 by listing at nearly 80% premium over the issue price. |

Funds Mobilization by Corporates (Rs. In Crore)

|

Particulars |

Oct-23 |

Nov-23 |

|

I. Equity Issues |

17,740 |

27,684 |

|

a. IPOs (i+ii) |

5,158 |

13,431 |

|

i. Main Board |

4,478 |

13,016 |

|

ii. SME Platform |

680 |

415 |

|

b. FPOs |

0 |

0 |

|

c. Equity Rights Issues |

130 |

112 |

|

d. QIPs/IPPs |

7,609 |

11,364 |

|

e. Preferential Allotments |

4,843 |

2,778 |

|

II. Debt Issues |

36,231 |

71,357 |

|

a. Debt Public Issues |

2,972 |

264 |

|

b. Private Placement of Debt |

33,259 |

71,357 |

|

Total Funds Mobilized (I+II) |

53,971 |

99,305 |

Acknowledgements:

RBI Bulletin (www.bulletin.rbi.org.in), SEBI (www.sebi.gov.in), NSE (www.nseindia.com), BSE (www.bseindia.com)

Disclaimer:

This material has been prepared by the personnel in Vora Corporate Finance which is Investment Banking arm of Vora Management Consultancy Private Limited and looks after Mergers & Acquisitions (M&A), Private Equity (PE), Fund Raising, Debt syndication and Valuations and is based out of Ahmedabad, Gujarat, India. Any views or opinions expressed herein are solely that of individual authors and may differ from view of Vora Management Consultancy Private Limited. This material is proprietary to Vora Management Consultancy Private Limited and is for your personal use only. Any distribution, copy, reprints or forward to others is strictly prohibited.

This material captures the information based on information available in the public domain, public announcements and sources believed to be reliable. Analysis contained herein is based on publicly available information and appropriate assumptions. This material is intended merely to highlight market developments and is not intended to be comprehensive and does not constitute strategic, investment, legal or tax advice. In no event Vora Management Consultancy Private Limited be liable for any use by any party or for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained herein and such information may not be relied upon by you for evaluating any transaction.